by Ong Kah Seng

05:55 AM Dec 31, 2010

2010 has been an impressive year for the landed housing segment, with prices rising 23 per cent in the first three quarters, including a 7.7-per-cent increase in the third quarter from the second.

Amid the outstanding overall results, the superlative in the landed housing segment - good-class bungalows (GCBs) - continued to shine. GCBs are essentially detached homes sitting on at least 1,400 sq m of land, in 39 designated areas such as Swettenham Road, White House Park, Nassim Road and Chatsworth Park.

Although the number of transactions of GCBs in the first 11 months of the year was similar to the corresponding period last year, the value transacted climbed to a new record high of $1.69 billion.

This is 18 per cent above the value of GCBs transacted in the whole of last year, the previous historic high.

The most striking achievement is that on a psf of land basis, the $1,052 average price of GCBs transacted this year reflected a 28 per cent increase in the first 11 months of the year.

This price rise was above a corresponding 25 per cent average annual increase for all landed residential properties.

Some GCBs have been sold repeatedly over the years, reflecting sustainable capital appreciation in this premium segment.

For example, a GCB in Nassim Road changed hands five times in the past six years - beginning from a transaction at $405 psf of land in Feb 2005 to a fifth in April this year at $1,800 psf of land.

DWINDLING SUPPLY, RISING DEMAND

GCB values, fundamentally underpinned by limited supply, have been given a further boost on the demand side from buyers who are increasingly discerning and contesting for homes with special selling points for future appreciation.

Moreover, with prices already at record highs, the cost of a home for a purchaser is becoming a secondary concern compared to the potential for capital appreciation.

GCBs, which are at the highest rung of private homes and which are unlikely to see a major rise in new completions, will be among the safest buys for a purchaser who is not burdened by affordability concerns.

A GCB, exclusive and rare in supply, is thus felt to offer more room for capital gains.

Singapore has embraced vertical city living over the past decade due to land scarcity. Developers' offerings are predominantly non-landed residential properties and choice landed homes, including some at off-the-beaten locations, are becoming more and more attractive.

Notwithstanding developers' efforts to brand condominiums with innovative concepts, such homes are fairly homogenous and the exclusivity is at most "development specific", i.e. there will be at least several similar units in a development with similar designs.

In contrast, buyers of GCBs will be able to customise their homes to be materially different from another.

Although many landed homes are not in a central location, i.e. close to major transport nodes, they will still be prized by those who value privacy and an exclusive environment, away from major activity areas and town centres.

Landed homes in off-the-beaten places may continue to receive buying interest predominantly for owner occupation, from those who wish to have differentiation between work and leisure.

The merit of GCBs is that many of such homes are centrally located, further enhancing their appeal to potential buyers of landed housing.

Some buyers are also interested in the redevelopment potential of the land on which the GCB sits.

GCB owners are often property connoisseurs who will only part with their home if prices significantly exceed personal value.

But while the limited supply will support price increases, buyers will not be hasty as a GCB purchase is a major decision.

MORE UPSIDE BUT AT A SLOWER PACE

Landed homes are also not likely to be significantly affected by the Government's efforts to cool the overall housing market.

This segment of the market is different from the non-landed residential sector as it appeals to buyers who are not burdened by affordability concerns and the case for Government intervention to ensure prices are affordable is weaker.

And if prices are suppressed, these properties will become even more attractive and the buying interest for such special value buys may further increase, notwithstanding new restrictions.

Going into 2011, the price increase for GCBs is expected to continue, backed by the sustained economic recovery and rising awareness of GCBs as special value buys.

But the rate of capital appreciation is set to slow to an expected 3 per cent per quarter increase next year, as higher prices face increasing resistance even as the product offerings are unique.

The writer is Senior Manager, Research - Asia Pacific at Cushman & Wakefield.

Source: www.todayonline.com

Spotlight on good-class bungalows

Posted by IM at 7:04 PM

Labels: freehold landed Property, Good Class Bungalow (GCB), landed residential property, Property News

Australia the next property investment hot spot?

by Jo-Ann Huang Limin

05:56 AM Dec 31, 2010

SINGAPORE - Australian real estate may present a good investment opportunity next year as a robust economy and a growing shortage of homes underpin prices that, according to analysts, have room to go up still further.

Analysts say that foreigners will be drawn to the market, with Chinese, Singaporean and Malaysian buyers continuing to lead demand. Despite restrictions on foreign buyers of Australian properties, Asian investors are still snapping up homes Down Under, especially in major cities such as Sydney and Melbourne.

"Foreigners do have restrictions. When they are selling, they have to sell to Australian nationals, but this doesn't seem to affect people," said Mr Julian Sedgwick, senior associate director for international residential sales at real estate agency Savills.

He said there were 800 enquiries received at Savills over a recent weekend for two or three property launches in Sydney.

"We sold about 25 per cent of the units from one such property and as many as 10 per cent to 15 per cent of the buyers are Asian," he said.

Prices of Australian homes have risen 56 per cent in the past 10 years. Yet the Housing Industry Association in Australia estimates that the price-to-income ratio is slightly lower today than it was in December 2007.

And options for home buyers are not limited to Sydney and Melbourne. With prices in these two cities reaching record levels - an inner-city one-bedroom home in Sydney currently commands up to A$750,000 ($984,000) - analysts say that it may be worthwhile for foreign home buyers to shift their attention to a city such as Brisbane, where prices are relatively lower.

To ward off the threat of asset bubbles, Australian policy-makers raised interest rates to 4.75 per cent last month.

But analysts say this will not put off Asian investors. Singaporeans, for example, can finance their Australian properties with loans pegged to a lower interest rate.

"We can actually borrow in Singapore dollars, so as a result our interest rate is about 1.5 per cent to 2 per cent," said Ms Donna Lim, head of overseas projects at HSR International Realtors.

For apartments in the central business district, "you probably would be able to get 6 per cent to 7 per cent, for houses in the suburbs you will probably enjoy 5 per cent rental return; so there's definitely a positive cash flow here," she added.

Due to high foreign demand and a lack of new housing supply in key Australian cities, market watchers expect property prices to rise as much as 8 per cent next year. An index of home prices in Australia's eight capital cities was 5.7-per-cent higher in the three months ended this September, compared with the final quarter of 2009.

Source: www.todayonline.com

Posted by IM at 6:55 PM

Labels: private property, Property News, residential property, singapore property

Clear the hogwash and whitewash

Wishes for next year: More market transparency and independent views in the property sector

by Colin Tan

05:55 AM Dec 31, 2010

When I was a student, I believed everything I read in the papers. If it appeared in print, it had to be true. When I did my stint as a reporter, I realised that not every bit of important information we gathered came out in print. Sometimes, alternative or opposing views just did not go well with the story flow.

These days, I advise my student interns not to believe everything they read and to be discerning, more so now than in the past, as there is a lot more "noise" in the market these days. While reporters used to hassle news-makers for information, a lot more information is pushed to the media these days.

Marketing views seem to predominate nowadays. Higher-priced properties are automatically classified as prime housing or as belonging to the luxury segment. An 800 sq ft or even a 1,600 sq ft unit, no matter how exquisitely finished, cannot qualify as a luxury unit. If you tell a foreigner from one of the developed economies that you have just purchased one such "luxury" unit, they will have a different notion of what you own. If you then tell them it is only 800 sq ft, they will break into laughter.

Small units in the Central Business District are also not prime apartments. A more accurate description would be inner-city apartments.

Doubled-storeyed top floor units are also not automatically penthouses. A 1,600 sq ft unit split into two floors atop a block in a private housing project is definitely not a penthouse - it is a maisonette. And there are no penthouses in the HDB resale sector, no matter what the agents say. A penthouse is almost always a luxury unit.

This week, an agent described the rising vacancy levels in one of the property segments as a "short-term statistical blip". If there is a short-term blip, should there not be a long-term blip? A blip is a result that goes against the trend in just one outcome. If it carries on for four quarters, it is a trend and no longer a blip.

Monthly data such as developers' sales should not just be compared against the result in the previous month. Or else, it will be good, bad, good, bad, ad infinitum. It should be compared against a monthly average. A year-on-year comparison is better if the market is seasonal in nature.

The time horizon for buying ahead of the curve should be restricted to one property cycle, which may be five years or seven years depending on the market segment. It makes no sense rushing to buy a project next to a future MRT station or in an emerging area if it is coming up only 10 years later or more. It would make better sense to wait to buy during the lowest point of the cycle.

Predicting an interest rate hike within the next five years is not worth the paper it is printed on. Even a student can do that.

And a report predicting a rental increase of 30 per cent over three years is not news; it amounts to an average of only 10 per cent each year.

Lately, I have seen some industry heads taking to publishing their own guide books. Browse around the bookshops and you will find them. Some pointers in these books are useful, while others are less so - and even misleading if you are not careful.

Schematic location maps of some future private housing projects also confuse more than they enlighten. The purpose, it appears, is to show as many amenities and attractions in "close proximity" to the project rather than the actual location. I sometimes have to refer to the street directory to find the project's actual location. I feel these developers not only do a disservice to buyers but also to themselves as they lose credibility in the long run.

Finally, I wish for more independent debate on property matters for next year. In this respect, I hope more academicians and economists will contribute their views to the media. Imagine how much more enlightening for the public as well as policy-makers if there are more insightful views on matters such as housing affordability and on the effectiveness of actual and potential cooling policy measures.

The writer is Head, Research & Consultancy, at Chesterton Suntec International.

Source: www.todayonline.com

Posted by IM at 6:52 PM

Labels: freehold residential property, Property News, residential property, singapore property, singapore real estate

210 property agents barred

They had criminal records or records of offences involving fraud or dishonesty

by Esther Ng

05:55 AM Dec 30, 2010

SINGAPORE - Come Saturday, 210 property agents will not be able to practise their trade. Their applications to register with the Council for Estate Agencies (CEA) were rejected as they were found to have criminal records or records of offences involving fraud or dishonesty.

Under the new regulations, it will be an offence for sales persons who are not registered with the CEA to handle estate agency work.

An applicant must also not be an undischarged bankrupt, nor must he have made a composition or arrangement with his creditors.

Additionally, the applicant must not be convicted of an offence involving dishonesty or fraud.

The tighter rules are part of an effort to professionalise the industry which had, in recent times, been blighted by the unethical practices of a few rogue agents.

Some people have questioned whether the new rules go against the spirit of giving offenders a second chance, especially if the offence was committed a while ago.

However, the CEA said that it would assess applicants with criminal records on a case-by-case basis, taking into account when the offence was committed and the severity of the offence.

Manpower Government Parliamentary Committee chairman Halimah Yacob, who had spoken in Parliament previously about more stringent industry standards, suggested the CEA could issue a provisional licence and monitor with input from the real estate firm.

The CEA pointed out that the 210 rejected agents make up less than one per cent of the 27,754 salespersons registered.

In addition, it clarified that there is no fixed debarment period or life-long debarment.

Instead, the length of debarment depends on the nature and seriousness of the offence.

Propnex chief executive Mohamed Ismail told MediaCorp that three of its agents were rejected.

"If the agent has been with us for some time and there are mitigating reasons, then we'll appeal," he said.

In October, it submitted 4,500 names of agents to the CEA - 4,104 have been approved, the rest are pending approval or have dropped out, he said.

Agencies have two weeks to appeal to the CEA.

They will need to provide full details and copies of relevant documents supporting their application. CEA will notify them of its decision after reconsideration. If they are still dissatisfied with CEA's decision, they can file an appeal.

To date, 1,190 real estate firms have been given licences and 27,754 agents have been approved.

From Jan 1, a public register of licensed firms and registered agents will be available on the Council's website. And from March, the register will display photographs of agents for easy identification.

Next month, the CEA will implement a dispute resolution scheme to resolve disputes and contractual matters between consumers and estate agents.

Real estate firms are required to participate in the scheme once the consumer has elected to proceed with mediation or arbitration.

Record of 3 unsuccessful applicants

Case 1 Applicant has a history of criminal/unlicensed moneylending convictions

1992 - Theft in dwelling

1993 - Loitering with intent

1994 - Theft of motor vehicle parts (3 charges)

1999 - Unlicensed moneylender (19 charges),

2006 - Unlicensed moneylending offences (33 charges)

Case 2 Applicant has a history of criminal convictions

1994 - Entering a Protected Place without permission

1998 - Theft in dwelling

1999 - Theft as a servant

2003 - Driving vehicle without lawful authority, licence, insurance coverage and speeding

2006 - Criminal trespass

2007 - Insulting the modesty of a woman (2 charges) and criminal trespass

Case 3 Applicant is a serious sexual offender and was charged in 2004 with 10 counts of having sex with underaged girl

Source:www.todayonline.com

Posted by IM at 3:13 PM

Labels: Council for Estate Agencies (CEA), Property Agent., Property News

Rents rose faster in Q4

SINGAPORE - High rentals continued to dog many businesses in the last quarter, with office rents rising at a faster pace in the fourth quarter, said real estate consultant DTZ Research said.

Average prime gross rents in Raffles Place rose 7.1 per cent on quarter to $9 per sq ft per month, from a 6.3-per-cent rise in the previous quarter. For the whole of this year, average prime gross rents in Raffles Place have increased by 13.9 per cent, DTZ said.

Park Regis and Solaris were completed in the quarter, bringing the new supply for the full year to 2.4 million sq ft.

DTZ said that island-wide office occupancy rose by 0.5 percentage points on quarter and 3.7 percentage points on year to 95.4 per cent. The net absorption of office space for the whole of this year was estimated at about 4.4 million sq ft, which includes about 1.7 million sq ft of pre-committed space.

Ms Chua Chor Hoon, head of DTZ South-east Asia Research, said that while there would be a substantial amount of new completions next year, it would be mitigated by the removal of an estimated 0.8 million sq ft of existing buildings for redevelopment.

"We project rents to move up at a slower rate next year until there are clearer signs of a recovery in the US and Europe, as this is still holding back widespread expansion, particularly among occupiers whose headquarters are based in these major economic regions," she said. Travis Teo

by Travis Teo

05:55 AM Dec 30, 2010

Source: www.todayonline.com

Posted by IM at 3:06 PM

Labels: commercial property, Office Rental, Property News

Office rental growth gathers speed in Q4

Office rental growth gathers speed in Q4

Published December 30, 2010

THE pace of office rental growth gained momentum in the fourth quarter of 2010, according to a new report from DTZ.

The firm said that average prime gross rents in Raffles Place rose 7.1 per cent quarter-on-quarter in Q4 2010 to $9 per square foot per month. This reflects an increasing rate of rental growth from Q3 2010 when rental values rose 6.3 per cent.

For the whole of 2010, average prime gross rents in Raffles Place increased by 13.9 per cent, DTZ said.

The net absorption of office space for the whole of 2010 is estimated to be about 4.4 million sq ft, although this includes about 1.7 million sq ft of space that was pre-committed.

Excluding the pre-committed space, which is being fitted out, the net absorption will be 2.7 million sq ft and the occupancy rate will be 92.7 per cent, DTZ said.

'Despite earlier concerns about the hollowing out effect when occupiers upgrade to new buildings, we notice that the vacated space is being taken up readily by existing tenants wanting to expand, or occupiers from other buildings,' said Angela Tan, DTZ's executive director for occupational and development markets.

But downward pressure on the occupancy rates of older secondary buildings can be expected, as tenants move to the better-quality buildings that are being vacated, she added.

An estimated 8.2 million sq ft of net lettable space could be available between 2011 and 2015, DTZ said. This includes government land sales sites that have been awarded to developers but have not received planning approval.

The bulk of the new supply, about three million sq ft, will be completed next year. New CBD office completions in 2011 include Asia Square Tower 1, Ocean Financial Centre, OUE Bayfront and One Raffles Place Tower 2.

DTZ expects rents to move up at a slower rate next year until there are clearer signs of a recovery in the US and Europe.

There is still holding back on widespread expansion, particularly among occupiers whose headquarters are based in these major economic regions, the firm noted.

Sporce: /www.businesstimes.com.sg

Posted by IM at 2:59 PM

Labels: Asia Square Tower 1, Ocean Financial Centre, Office Rental, One Raffles Place Tower 2., OUE Bayfront, Property News

CEA starts licensing firms, agents

Nod for 1,190 property firms, 27,754 agents; public register on CEA website from Jan 1

By UMA SHANKARI

Property

Published December 30, 2010

THE newly set up Council for Estate Agencies (CEA) has approved 1,190 licence applications from real estate firms as well as 27,754 registration applications for property agents, it said yesterday.

Previous estimates from the government - provided before CEA was set up - put the number of property firms and agents at 1,700 and 30,000 respectively. But industry players were expecting the number of firms and agents to fall with the establishment of the industry watchdog and stricter rules.

CEA also said that it turned down 210 applicants who do not meet the required criteria to be agents. The denied would- be agents were mainly found to have criminal records or records of offences involving fraud or dishonesty.

A public register of licensed firms and registered agents will be available on CEA's website from Jan 1. The register will display the name, licence or registration number, the firm the agent is working for, validity period, and records of offences committed or disciplinary actions taken, if any. Recent photographs of agents will also be available for easy identification from March 1.

CEA has been receiving licensing applications from both new and existing real estate firms since Nov 1. Property firms were also required to register salespersons who meet all of CEA's criteria by Nov 30.

Going forward, CEA will also implement a prescribed dispute resolution scheme - involving mediation and arbitration - in January. Firms are required to participate in the scheme once the consumer has elected to proceed.

The agency also clarified yesterday that estate agency work concerning land banking products will not be regulated under the Estate Agents Act 2010.

Said CEA: 'This is because estate agents marketing land banking products are more likely to provide financial investment advice than to make representations on a property. Consumers should practice caution and exercise due diligence when investing in land banking products.'

Source: www.businesstimes.com.sg

Posted by IM at 2:54 PM

Labels: Council for Estate Agencies (CEA), Property Agent., Property News, singapore real estate

Honey, I shrunk the flat, but it's just us now

Honey, I shrunk the flat, but it's just us now

HDB flats are smaller than before but may provide more space as families shrink

By EMILYN YAP

Top Print Edition Stories

Published December 30, 2010

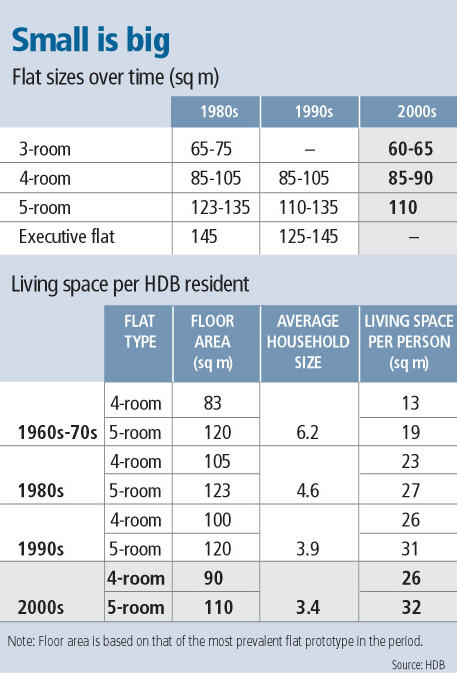

(SINGAPORE) HDB flats have gotten smaller over the years, but most occupants today should actually have more space to themselves as the size of families has also shrunk.

Data that BT obtained from HDB reflects this trend. From the 1980s to 2000s, all types of flats have been scaled down. The changes appear most noticeable between the 1990s and the 2000s.

For instance, a five-room flat built in the last 10 years would measure around 110 square metres, but an older one from the 1990s would be 110-135 sq m, while another hailing from the 1980s would measure some 123-135 sq m.

HDB explained that it 'reviews flat sizes regularly, taking into consideration changes in demographic trends and lifestyle habits, as well as the need to optimise limited land available for housing'.

Home hunters have noticed the change in flat sizes. The difference stands out particularly to those who have been shopping for resale flats across estates, said Dennis Wee Group director Chris Koh.

PropNex chief executive Mohamed Ismail agreed that flats have become smaller in the last 20 to 30 years, but pointed out that there has also been a more 'efficient use of space'.

For instance, most new flats no longer come with large balconies and long corridors. In addition, glass panels have become an increasingly common feature because they create a sense of spaciousness, he said.

While HDB's data confirms that flats have become more compact, it also highlights something less obvious to the casual observer - many residents today should have more living space because their families are smaller.

According to official surveys, the average household size was 3.4 in the 2000s and 4.6 in the 1980s. This means that an occupant in a relatively new 110 sq m five-room flat is likely to have 32 sq m of space to himself, while someone living in a 123 sq m five-roomer in the 1980s probably had just 27 sq m of space.

'Over the years, while flat sizes have been adjusted, living space per person has improved for HDB residents as household size has decreased . . . due to the nuclearisation of families and formation of smaller families,' HDB said.

HDB 'will continue to provide a wide variety of flats and ensure that flat sizes are reviewed regularly to cater to prevailing and future needs'.

Property agents note that flat sizes alone do not influence homebuyers' decisions - other factors such as location and amenities come into play.

As Mr Ismail shared, many people are looking forward to waterfront living in Punggol, even though flats in the area are likely to be smaller than those in older estates such as Yishun. 'The environments cater to different needs. There are pros and cons,' he said.

Still, industry watchers are not keen - and do not expect - to see flats getting smaller as they have to accommodate families.

'There's very little that you can cut back on, unless you want to cut back on the yard area . . . As it is, the room sizes are just nice,' Mr Koh said.

In the private housing sector, condominium units have also shrunk in size. The trend picked up pace from early 2009 when projects with a large proportion of shoebox units measuring less than 500 sq ft started to emerge. Developers have an incentive to keep units small so that they remain affordable even if prices in per square foot terms are high.

BT reported recently that the authorities have been projecting housing supply in the Government Land Sales programme by using smaller estimates for the average size of non-landed homes.

Market watchers do not believe that HDB flats will go the way of shoebox apartments. These private projects 'cater to investors who want to own a second property or to a single who wants to buy . . . but public housing is for a family nucleus', Mr Ismail said.

Source: www.businesstimes.com.sg

Posted by IM at 2:42 PM

Labels: HDB, hdb singapore, Property News, residential property, shoebox apartment, singapore property, singapore real estate

Chinese buyers home in on Singapore

by Chris Howells

05:55 AM Dec 29, 2010

SINGAPORE - It has been a good year for agents selling luxury properties to foreigners in Singapore. Ms Jasmine Png, an associate director with real estate agency OrangeTee, says she has never before seen as many earnest buyers from China.

What's drawing them here are "the tightening measures in China and Hong Kong, which have actually made the Singapore residential market look appealing," said Ms Png. The "relative ease in obtaining financing for purchasing Singapore properties" is also helping, she added.

Credit is getting costlier in China. The central bank raised the benchmark interest rate by 25 basis points to 5.81 per cent last Saturday, the second increase since October. Analysts expect another 100-basis-point increase in the first half of next year. They say that the People's Bank of China (PBOC) is still behind the curve in combating inflation and will likely employ a slew of measures next year to contain rising consumer prices and cool the overheated property market.

The authorities in Beijing have already banned mortgages for third-home purchases and restricted developers from pre-sales of properties. These steps, along with the threat of a property tax, have driven some buyers to overseas markets.

According to Singapore's Urban Redevelopment Authority, Chinese nationals have snapped up 1,474 private properties so far this year, surpassing the 1,448 purchases made by Indonesian buyers.

Chinese nationals have accounted for 5.3 per cent of the local private housing market this year. Among foreigners, they are second only to Malaysians, who make up 6 per cent.

In the third quarter, Chinese buyers accounted for 20 per cent of all foreign purchases in Singapore's housing market, the highest ever, according to property consultancy DTZ. Although Singapore, too, has taken steps to damp speculative fervour in the property market, the low borrowing costs here are attracting foreigners, especially the Chinese, who are expecting a significant increase in their home-country interest rates next year.

In the PBOC's previous tightening cycle from March 2006 to August 2008, the central bank raised the lending rate by 189 basis points to 7.47 per cent and increased the reserve requirement ratio for banks by 1,000 basis points, to 17.5 per cent.

After Saturday's increase, the lending rate is currently at 5.81 per cent, though at 18.5 per cent, reserve requirement ratios are already above pre-crisis highs.

Source: www.todayonline.com

Posted by IM at 6:43 AM

Labels: luxury condos, luxury residences, private property, Property News, singapore property, singapore real estate

181 Soho units at The Tennery sold

Published December 29, 2010

By UMA SHANKARI

FAR East Organization has sold 181 Soho-style (small office, home office) apartments in its 338-unit The Tennery.

The developer said yesterday that it released 217 units of its newest residential project, at Bukit Panjang, in a preview. A total of 181 units were sold at prices ranging from $950 per sq ft (psf) to $1,300 psf.

The 99-year leasehold The Tennery is part of an integrated residential and retail development Far East is building on the Ten Mile Junction site it won in a government tender in February.

Far East paid $164 million or $437 psf per plot ratio for the site at the junction of Choa Chu Kang and Woodlands roads.

In addition to The Tennery, the site will also house a 121,000 sq ft retail development called Junction 10.

Some 80 per cent of The Tennery's buyers are Singaporeans and permanent residents, Far East said. It added that most of the buyers are professionals living in the Bukit Panjang, Choa Chu Kang, Bukit Batok and Hillview areas, who are familiar with the neighbourhood.

Far East Organization's executive director and chief operating officer Chia Boon Kuah said that an increasing number of people are looking for versatile living spaces that allow them to work from home.

This development, he said, is flexible, expandable and designed for maximum functionality.

The Tennery's one-bedroom apartments range from 619 sq ft to 640 sq ft in size, while two-bedders range from 860 sq ft to 950 sq ft in size. Far East will release more units during the project's official launch on Jan 1, 2011.

In 2010, including The Tennery, Far East has launched nine residential projects in Singapore. Other launches included Altez in the Tanjong Pagar area, The Greenwich at Seletar Hills and Skyline@Orchard Boulevard

Source: www.businesstimes.com.sg

Posted by IM at 3:10 PM

Labels: Altez, condo for sale, condo launch, residential property, singapore real estate, Skyline at Orchard Boulevard, The Greenwich, The Tennery

High-end condos can't keep pace with mass-market hikes

Published December 29, 2010

High-end condos can't keep pace with mass-market hikes

Prices in Non-Central region top pre-crisis high, Central region 3.7% below peak

By KALPANA RASHIWALA

(SINGAPORE) The latest flash estimates for November from the National University of Singapore (NUS) show that prices of non-landed private homes in Singapore's Central region (districts 1-4 and 9-11) have appreciated 7.9 per cent in the first 11 months of this year from end-2009.

Over the same period, the Singapore Residential Price Index (SRPI) sub-index for the Non-Central region rose at a faster clip of 12.9 per cent. As a result, the overall SRPI increased 10.7 per cent year to date.

SRPI, compiled by the NUS Institute of Real Estate Studies, covers only completed properties.

The Central region sub-index for November is still 3.7 per cent shy of its pre-Global Financial Crisis peak in November 2007. On the other hand, the sub-index for the Non-Central region in November has already surpassed its January 2008 pre-crisis peak by 15 per cent. As a result, the overall November 2010 index is about 7.6 per cent above its November 2007 pre-crisis high.

The latest indices from NUS tally with what property agents have been reporting from the ground - that mass-market condo prices have scaled fresh records this year while prices of prime and luxury condos have yet to touch their 2007 records.

DTZ executive director (consulting) Ong Choon Fah said that entry-level suburban condos have enjoyed strong demand this year, riding on upgrader demand amid a buoyant HDB resale market.

'In addition, the trend of developing a higher proportion of smaller units in private residential projects has spread from the prime districts (where rental demand is stronger) to the suburbs - and this has also helped to boost sales of mass-market projects by making the lump sum investment more palatable to buyers.'

Mrs Ong also pointed out that these days, developers of suburban projects are offering some of the innovative features which in the past were available only in prime district projects - such as sky gardens.

Knight Frank chairman Tan Tiong Cheng said that the increase in high-end condo prices had not been so sparkling this year due to more subdued foreign buying compared with the previous bull run in 2007.

'The foreign buying back then was from a wider spectrum. These days, buyers from the West, Middle East and Russia seem to be out of the equation. Also Western bankers were a significant buying contingent in 2007 but post-crisis, banks are less generous with remuneration.'

Month on month, the overall SRPI dipped 0.2 per cent in November. The sub-index for the Non-Central region too eased 0.3 per cent but the Central region sub-index was flat.

Since the last round of property cooling measures on Aug 30, the Central region sub-index has eased 0.4 per cent while the non-Central index has strengthened 0.9 per cent. As a result, the overall index in November was 0.4 per cent ahead of the August level.

Despite being proven wrong with their earlier forecast of stronger price appreciation for high-end condos compared to mass-market ones for 2010, analysts continue to predict the same trend in 2011, pointing to the already substantial price hikes posted in the mass-market segment. And if the government succeeds in taming HDB resale prices, that will also have an impact on upgrader demand for entry-level condos. Also, any interest rate hike, as well as further property cooling measures, is likely to make a bigger dent on demand in the mass-market segment than on upmarket condos

Source: www.businesstimes.com.sg

A mild collective sale fever

Published December 28, 2010

A mild collective sale fever

Most of the en bloc sales this year transacted at less than $50 million each, writes NICHOLAS MAK

THE residential en bloc or collective sales market in Singapore is picking up again in 2010 after taking a hiatus last year. To date, some 30-odd en bloc sales amounting to about $1.6 billion have been successfully concluded.

Meng Garden Apartments: With just 27 units, the project at Lloyd Road fetched $137m in an en bloc sale, the largest transacted this year. During the height of the boom in 2007, the average en bloc sale value was $119.3m

However, unlike the en bloc sales fever of 2005 to 2007, the size of each collective sales transacted in 2010 was smaller by comparison.

Most of the collective sales of residential developments transacted this year were less than $50 million each. The average value of each deal was about $52.6 million.

The largest collective sale transacted in 2010 was that of the 27-unit Meng Garden Apartments at Lloyd Road, which was sold for $137 million. By comparison, the average value of each collective sale that was concluded during the height of the previous property market boom in 2007 was $119.3 million.

The size, in terms of land area and the number of existing apartments, of each collective sale that was transacted in 2010 was also smaller. The average land area of the collective sales properties concluded in 2010 is about 36,000 sq ft, which is dwarfed by the average 105,000 sq ft of land of the en bloc sales in 2007.

Typically, about 94 per cent of the successful collective sale developments in 2010 consisted of less than 50 existing units. The average size is about 22 existing units in each project.

By contrast, the average number of existing units of the successful collective sale projects in 2007 is about 3.5 times larger.

The prime residential areas also witnessed fewer collective sales this year. Only about one-fifth of the successful en bloc sale developments in 2010 were located within the prime Districts 9, 10 and 11. The total transacted value of these en bloc projects in the prime districts added up to $678 million.

A significant number of collective sales projects were situated in the city-fringe areas, such as Districts 12 and 14. In 2007, the prime districts held about half of the 104 successful collective sales.

Government land sales

These prime district en bloc sales properties had a combined transacted value of some $8.5 billion.

One of the reasons for the smaller and fewer collective sales in 2010 is that many of the bigger developments in the prime districts and the popular East Coast region that could potentially be collective sales projects were already sold to developers in 2005 to 2007.

A second reason is that the flood of development sites from the Government Land Sale (GLS) programme for 2010, especially for the second half of this year, had attracted the attention and resources of many developers.

In response to the increase in housing demand and prices in 2009 and 2010, in the second half of 2010, the Singapore government released the largest supply of residential development land in the past 15 years. The 18 land parcels to be sold through the Confirmed List in H2, 2010 could potentially yield 8,300 housing units. In addition, there are another 13 sites on the Reserve List that could be developed into 6,000 homes.

So far this year, the authorities have sold 20 private 99-year leasehold residential sites amounting to $3.63 billion and another eight executive condominium (EC) sites that fetched $1.32 billion. This is not including the 14 smaller land parcels at Sembawang designated for landed housing that were auctioned off for $134.6 million in October.

In total, the government's residential land sales in 2010 had absorbed about $5.1 billion of funds from developers, which is more than three times the amount that developers spent on private en bloc sales.

Some developers prefer to acquire GLS sites because the process is faster and more transparent. In almost all government land tenders, all the names of the bidders and their respective bids are revealed hours after the close of the tender.

By comparison, property agents who conduct en bloc sales are never known to reveal the list of bidders and their bids in the same manner as the government.

Furthermore, once the highest bid exceeded the government's reserve price, the authorities would usually award the site to the highest bidder within a week after the close of the tender.

By comparison, some en bloc sales can be long drawn-out dramas, including protracted litigations, especially if some of the owners objected to the en bloc sale strongly or the estate agents had made some administrative mistakes.

Another reason why developers have been drawn to GLS tenders is the market segment that has enjoyed the most robust sales in the past two years is the mass market.

Condominium projects that are located near MRT stations are highly popular with homebuyers, provided they are priced reasonably. Developers are only too aware of this fact and there is a good selection of such land parcels in the recent GLS programmes.

The type of land that developers will buy would depend on the type of products that they are confident that they can sell at an attractive profit margin. The present trend of developers preferring small en bloc projects could continue into the first half of 2011.

This is because there are few indications that the sale volume in the high-end residential market would surge in the next few months.

In the past eight months, the sales volume of private homes in the prime districts had been relatively lacklustre as they made up less than one-fifth of the total number of private homes sold by developers.

On average, between April and November this year, 224 housing units in the Core Central Region (CCR) were sold in the primary market each month, while developers sold an average of 486 units and 642 units in the city-fringe and suburban regions respectively.

Furthermore, the asking price of the owners of the collective sales projects are unlikely to soften as they factor in the rising replacement cost of their new homes. Most collective sales could take months to conclude. And during that period, home prices could continue to rise.

But some developers may be turned away by the high asking prices as they could acquire the relatively cheaper GLS sites. Ironically, the very market forces that drive the en bloc sales market could also derail some of the potential deals.

Mega deals

In January 2011, four collective sales tenders are scheduled to close, including those with reserve prices exceeding $600 million each. It is an uphill task to successfully conclude such mega deals mainly because it would require the developer to put many of his eggs in one basket.

With a budget of $600 million, the developer could possibly acquire three to four GLS sites or 12 smaller en bloc sales sites, thereby diversifying his risks.

Each of the 20 GLS private condominium sites were sold by the government in 2010 for an average of about $181.4 million, while a large majority of collective sales in 2010 were transacted below $50 million each.

In addition, there is the risk of more cooling measures by the government in 2011. Any new government intervention is likely to further target property investors, while sparing first-time homebuyers.

And since a significant proportion of the high-end property buyers are investors and very few first-time homebuyers can afford luxury properties, any new property market curbs by the government is likely to affect the mid-tier and high-end segments.

However, there are also some major developers who are interested to acquire freehold trophy sites to add to their land bank.

But they are rather selective and the total land price, including the development charge that is payable to the government, is just one of the key selection criteria for the land parcels to be purchased.

In the coming year, there will be more collective sales attempts as some property owners try to cash in on the rising market.

In the face of such eagerness to sell, it is quite probable that one or two mega en bloc sales could be concluded in 2011.

However, the en bloc sales market in 2011 is unlikely to reach the red hot level of 2007.

Nicholas Mak is executive director (research & consultancy), SLP International Property Consultants

Source: www.businesstimes.com.sg

Posted by IM at 2:58 PM

Labels: en bloc, Meng Garden Apartments, private property, residential property, singapore real estate

Housing a nation - today and tomorrow

by Mah Bow Tan

05:55 AM Dec 24, 2010

When Kit Chan performed Home at this year's National Day Parade, she struck a chord with many in the crowd, including me. This is my home. This is where people can "build our dreams together". This is what "will stay within me, wherever I may choose to go".

Over the last few months, in this series of articles, I have explained how the Government strives to foster a sense of home and belonging for all Singaporeans through a massive public housing programme. In this final column, let me sum up how the Housing & Development Board delivers this housing commitment in three ways: Homes for the masses, home ownership and homes for life.

HOUSING FOR HOMEBUYERS

Homes for the masses: The HDB builds and prices flats to achieve home ownership for the masses. Unlike some other countries where public housing caters to the poorest minority, the HDB's mission is to house the masses so that we can build an inclusive nation. But we face two growing challenges.

As we become a nation of home owners, demand from flat buyers - many with existing homes - has grown more volatile and sentiment-driven. Oversupply is as worrying as undersupply. Therefore, the HDB moved to the current Build-To-Order system, so that its new flat supply can respond to demand changes, while keeping a small buffer for contingencies.

As Singapore progresses, the people's aspirations are also rising and becoming more diverse. While standard flats will continue to form the bulk of new flat supply, the HDB has to build different flats for different budgets and aspirations, so that public housing remains an inclusive home for Singaporeans.

Home ownership: This is the second hallmark of our housing system. We provide homes for ownership, rather than for rent, so that Singaporeans have a clear stake in the country's prosperity. But even as flats appreciate in value to the benefit of home owners, housing must remain affordable for first-time buyers. The HDB therefore sets aside new BTO flats for first-timers and prices them at a substantial subsidy relative to market value. The HDB also provides housing grants for first-timers to buy resale flats. This helps to ensure affordability and equity in subsidies.

Today, nine in 10 residents own their HDB flats and about 15,000 young couples become home owners every year. Beyond international measures like the Home Price Index (HPI) and the Debt Service Ratio (DSR), our high ownership rate is the clearest indicator that flats remain affordable for first-timers. Most couples buying new flats use only 20 to 25 per cent of their monthly income through CPF contributions to pay for their housing loans, without any cash.

For the minority who cannot readily afford to own flats, public rental flats represent the final safety net. Even then, the HDB and social agencies strive to help these families improve their situations so that home ownership remains a long-term hope for them.

HOUSING FOR HOME OWNERS

Homes for life: The HDB takes a life-cycle approach to its relationship with residents. It helps young couples buy their first homes. It rejuvenates the homes and estates of the existing 900,000 home owners. It also helps older home owners right-size their homes for retirement while they remain staying within their community. Ultimately, HDB flats are not only homes but also an asset whose value can be unlocked, if needed.

Rejuvenating our homes: By 2015, more than 200,000 flats will be at least 30 years old. For older flats to remain attractive and sustain their value for home owners, the HDB embarked on a massive estate renewal programme since the '90s, focusing on Main Upgrading, Interim Upgrading, and Lift Upgrading (LUP).

Since 2007, estate renewal has taken on a larger dimension under the "Remaking Our Heartland" programme. This goes beyond upgrading works by HDB and pulls together efforts by different agencies to give an entire town a makeover. We will breathe new life into the heartlands by injecting new housing, rejuvenating town centres and developing new amenities and recreational areas. These include park connectors, cycling paths, heritage trails, and Active, Beautiful and Clean Water features.

In addition to enhancing the value of HDB flats, rejuvenation must focus on making towns more sustainable. Sustainability is about being able to use our land, energy and water more effectively as well as reducing waste. Punggol will be developed as our first eco-town. Lessons learnt there will be drawn for use in existing towns.

Right-sizing our homes: By 2030, one in five residents are expected to be aged 65 and above. Our HDB estates and policies must prepare for the different needs of elderly home owners. The HDB has begun to upgrade our physical environment to be more elder-friendly. All estates will be barrier-free by next year. The LUP is also on track to provide 100 per cent lift access to all eligible blocks by 2014.

As our population ages and family sizes shrink, Singaporeans may face less family support in their old age. Some may want to right-size and unlock their housing asset. HDB has put in place various options. Under the Lease Buyback Scheme, elderly home owners can receive a long-term income stream without uprooting from their surroundings. Elderly flat owners can also rent out spare rooms or whole flats for income, as their children grow up and move out. The elderly can also choose to right-size and buy studio apartments that are better equipped for their needs.

Building cohesive communities: Besides looking after individual home buyers and owners, the HDB's larger mission is to build cohesive communities. The HDB experience is an important part of the Singapore story where people of different backgrounds, ethnicities and incomes live harmoniously together as a community.

This is why the HDB spends considerable effort on planning our estates, down to the layout of blocks, precincts and neighbourhoods. HDB void decks, playgrounds and precinct pavilions are just some of the spaces carefully designed for residents to mix and mingle as part of their daily routine.

HOMES WHERE WE BELONG

When the HDB was formed in 1960, its pressing challenge then was to solve the huge housing shortage for Singaporeans. Fifty years on, the HDB has succeeded beyond expectations and received numerous international accolades for its achievements. I am thankful for the selfless contributions of the many men and women in the HDB through the years who have made it possible.

What about the next 50 years and beyond? Clearly, the focus of the HDB's challenge will evolve. Besides providing attractive and affordable flats for new homebuyers, the HDB's greater challenge will be to sustain the quality of life, community bonds and value that HDB flats bring to home owners, even as our estates mature.

While the challenges in the next phase will be different, the HDB's core mission of building homes and bringing hope of a better life for hardworking Singaporean families remains unchanged. With the continued support of other agencies, community leaders, and residents, I am confident that we can build an even better home for all - one where "we'll build our dreams together. Just like we've done before".

To all those who have followed this series of articles and given me comments, feedback and suggestions, let me say a sincere "thank you". I am also grateful to Today for providing me this platform to engage Singaporeans on this very important subject. Finally, I wish everyone season's greetings and a very happy and successful 2011.

The writer is the Minister for National Development. This is the last of nine commentaries that he has written exclusively for Today.

Source: www.todayonline.com

Posted by IM at 7:18 AM

Labels: HDB, HDB resale, hdb singapore, Mah Bow Tan, Property News, residential property, singapore real estate

Robertson Quay hotel site up for tender

Published December 24, 2010

Robertson Quay hotel site up for tender

Industry watchers expect to see keen demand for the land parcel

By EMILYN YAP

THE Urban Redevelopment Authority (URA) will be putting a hotel site at Robertson Quay up for tender, after a developer committed to pay at least $51.5 million or $378 per square foot per plot ratio (psf ppr) for it.

Industry watchers expect to see keen demand for the site, even as several other hotel plots enter the market.

Interest in hotel development has grown this year along with swelling tourism numbers and a smooth economic recovery.

The 99-year leasehold land parcel at Robertson Quay is 0.45 hectare big and has a maximum gross floor area of 136,174 sq ft. URA estimates that it can yield 350 hotel rooms.

The site is near the Singapore River and is located within a hotel cluster which includes developments such as Gallery Hotel and Studio M Hotel. It is also next to residential projects such as Rivergate and Robertson 100.

In addition, food and beverage and entertainment outlets at Robertson Quay and Clarke Quay are within walking distance.

URA will launch the tender for the hotel plot in two weeks' time. Cushman & Wakefield Singapore vice- chairman Donald Han believes there will be a 'healthy dose of demand' for the site, with bids going up to $750-$800 psf ppr.

That estimate comes close to the price fetched by a hotel site nearby at the junction of Clemenceau Avenue and Havelock Road in August. The top bidder had paid $101.1 million or $813 psf ppr.

The Robertson Quay plot does not enjoy the same road frontage as the one at Clemenceau Avenue/ Havelock Road, but that may make the former suitable for building some residential units, and the residential play could enhance the value of the site, Mr Han said.

Under zoning guidelines, developers can use up to 40 per cent of a hotel site's total floor area for commercial or residential use, subject to official consideration.

Although developers have triggered the sale of a number of hotel sites this year, demand should stay strong if the economy does well and visitors keep coming, Mr Han said. He added that several hotel operators are still trying to gain a foothold in Singapore.

CBRE Hotels Asia-Pacific executive director Robert McIntosh believes that the site will fetch a 'good price' and attract some five to 10 bidders.

Hotel room rates and occupancies in Singapore have been rising this year and the outlook remains 'pretty positive' even with more supply coming on stream, he said.

According to a CBRE Hotels report, revenue per available room gained 24 per cent to about $181 in the first nine months of this year, and room rates rose 11 per cent to around $211.

With sentiments improving, developers have gotten hungrier for hotel sites this year. Two other hotel sites are still up for tender - one at Gopeng Street/Peck Seah Street and another at Ogilvy Centre.

Sites with a mandatory hotel component have also been sold this year, such as that at Peck Seah Street/ Choon Guan Street and another at Stamford Road/ North Bridge Road.

Source; www.businesstimes.com.sg

Posted by IM at 3:20 PM

Labels: Government Land Sales, land for sale, Robertson Quay hotel, URA

$36m Sentosa Cove deal called off?

05:55 AM Dec 23, 2010

SINGAPORE - The record $36 million deal for a bungalow at Paradise Island on Sentosa Cove has reportedly been called off.

According to Lianhe Zaobao, the buyer - identified in earlier media reports as Mr Shen Bin, a 31-year-old Chinese national who is a Singapore Permanent Resident - has backed out of the deal and lost about $500,000 in deposit, agent fees, legal fees and procedural fees.

The newspaper said the buyer called off the deal after he realised he paid over the market rate, after reading media reports surrounding the sale. The deal - touted as the priciest in the upscale waterfront housing district - came to light in June, based on caveat records captured by the Urban Redevelopment Authority and was said to have been signed on May 3.

Currently the chief financial officer, Mr Shen Bin is slated to take over his father, Mr Shen Wen Rong's company, Chinese firm Sha Steel.

Source: www.todayonline.com

Posted by IM at 6:59 AM

Labels: freehold landed Property, landed residential property, Property News, Sentosa Cove, singapore real estate

A sizzling year for Asian property markets

Runaway private housing prices compelled governments to impose cooling measures, with varying results

by Jo-Ann Huang Limin

05:55 AM Dec 23, 2010

SINGAPORE - Asia's residential property market stole much of the limelight this year as concerns of record property prices spurred government intervention in the form of repeated cooling measures. Singapore, China and Hong Kong were among the jurisdictions that have introduced anti-speculative measures to cool down their red-hot property market.

China was at the forefront of introducing price controls after property prices in the country surged 7.7 per cent over an 18-month period. This prompted the government to introduce measures such as a ban on mortgage loans for third properties.

In Hong Kong, prices grew by 50 per cent this year alone and to curb the rapid increase, policymakers had imposed a 15-per-cent stamp duty last month on properties sold within six months of its initial purchase.

These measures are considered drastic, said analysts, but have worked to cool the property market, albeit with varying results.

In Hong Kong, weekend sales of homes in the resale market dived 83 per cent immediately after the stamp duty tax was increased. But Hong Kong property market watchers still believe residential property prices could increase by 10 per cent next year.

"After the introduction of the stamp duty in Hong Kong, a lot of developers criticised the move for overdoing it," said Mr Colin Tan, head of research and consultancy at Chesterton Suntec International.

Singapore also implemented its own set of cooling measures, the latest of which were introduced in August. They include lowering the mortgage loan-to-value ratio to 70 per cent for owners intending to buy a second and subsequent properties.

The measures had some slowing effect on the property market, but robust housing demand, low interest rates and ample liquidity meant that the measures did not deter home buyers.

Latest home sales figures from the Urban Redevelopment Authority (URA) highlighted that, despite the cooling measures, last month saw sales hitting 1,909 units - a spike from 1,058 units in October.

However, quarterly prices fell signficantly since the introduction of the measures - private residential property prices grew at 5.6 per cent and 5.3 per cent in the first two quarters of this year, dropping significantly by the third quarter to 2.9 per cent following the latest batch of cooling measures.

Singapore's cooling measures were aimed at reducing speculative activity in the market, and analysts said that it has indeed achieved its objective to varying degrees. Yet, the market has remained robust and analysts said that it is because of the strong underlying demand for private homes, and not speculation, which has driven the market higher in recent months.

"The last round of Government cooling measures, which imposed several restrictions on re-selling, was ultimately incrementally adjusted by homebuyers," said Mr Ong Kah Seng, Cushman & Wakefield's Asia-Pacific senior manager of research.

"Many homebuyers are currently buying with the self prophecy that not buying a property now will mean one will miss the opportunity ahead - hence many are buying to fulfil the aspiration to own a piece of private property instead of hoping to make quick profits from it," he added.

To meet the demand in housing, the government will release about 30 land sites next year - roughly the same number of sites released this year.

Those balloting for their Housing Development Board (HDB) flat also have more reason to cheer. In the first quarter of next year, HDB will launch about 5,000 Build-to-Order HDB flats.

Still, some analysts expect more cooling measures to emerge next year. "It is inevitable," said Chesterton's Mr Tan.

URA's property sales and price data recorded this month will ultimately decide on the need for more cooling measures, said analysts. But they may not be as drastic compared to those imposed by Hong Kong and Chinese policymakers, analysts said.

Curbing demand too drastically may spell bad news for developers, too. "If prices fall too hard, this may mean thinner profit margins for developers," said Mr Tan.

Further steps may include tightening CPF policies to reduce withdrawal limits and lowering the loan-to-value ratio, particularly for second home mortgages, said Mr Ong.

Analysts said with a bright economic outlook going forward, coupled with low-interest rates and ample liquidity, home prices may still increase about 5 to 12 per cent next year.

MediaCorp also understands that the URA is seeking reactions and feedback from property consultants to study the need for more regulation in the sector.

Source: www.todayonline.com

Posted by IM at 6:56 AM

Labels: Property News, singapore property, singapore real estate

2010's last BTO project launched in Punggol

by S Ramesh

05:55 AM Dec 23, 2010

SINGAPORE - The Housing and Development Board (HDB) has launched its last Build-To-Order (BTO) project for this year, the Punggol Topaz, with 1,010 standard flats. With the launch yesterday, the HDB would have offered 17,713 new flats under the BTO and Sale of Balance Flat exercise this year.

Punggol Topaz, located along Punggol Way and Punggol Field, comprises 184 three-bedroom units, 542 four-bedroom and 284 five-bedroom flats, with 95 per cent of the flats set aside for first-timers. The facilities there will include a supermarket, an eating house, shops, a child care centre and a Residents' Committee Centre.

The Punggol MRT/LRT station, bus interchange and future town centre are nearby. Tampines Expressway and Kallang-Paya Lebar Expressway are a short drive away.

In line with the HDB's plans to develop Punggol as an eco-town, Punggol Topaz is designed for Green Mark Certification.

The layout of blocks and units is oriented to minimise heat gain from the sun. It will have features such as dry ponds and rain gardens, which help to maintain the quality of surface run-off from rainwater before it is discharged into the drainage system.

Selling prices for the flats range from $166,000 to $207,000 for three-bedroom units, $267,000 to $329,000 for four-bedroom and $335,000 to $406,000 for five-bedroom flats.

PropNex corporate communications manager Adam Tan said: "Compared with our transactions in PropNex for November 2010, the prices for the 4-room and 5-room flats in Punggol Topaz are 25 per cent and 19 per cent cheaper than prevailing resale prices."

Next year, the HDB is prepared to launch up to 22,000 new BTO flats, if demand is sustained. It will launch about 5,000 BTO flats - in towns such as Bukit Panjang, Jurong West, Yishun and Sengkang - in the first quarter.

The next BTO launch in January will offer 1,700 flats in Bukit Batok and Yishun.

Source: www.todayonline.com

Posted by IM at 6:55 AM

Labels: Build-to-order (BTO), HDB, hdb singapore, Property News, singapore real estate, the Punggol Topaz

HDB launches 1,010 BTO flats in Punggol

Published December 23, 2010

HDB launches 1,010 BTO flats in Punggol

By UMA SHANKARI

THE Housing & Development Board (HDB) yesterday launched another 1,010 new flats for sale in its latest build-to-order (BTO) project, Punggol Topaz.

Including this launch, HDB has now offered a total of 17,713 new flats for sale under its BTO and sale of balance flat exercises in 2010, it said.

And the agency will continue to roll out new supply at a steady rate next year. It plans to launch about 5,000 new BTO flats in the first quarter of 2011, including 1,700 flats in Bukit Batok and Yishun in January.

For the whole of 2011, HDB is prepared to launch up to 22,000 new BTO flats if demand is sustained, it said.

Punggol Topaz, located along Punggol Way and Punggol Field, comprises 184 three-room, 542 four-room and 284 five-room standard flats. Some 95 per cent of the flat supply will be set aside for first-timer households.

Selling prices range from $166,000 to $207,000 for a three-room flat; $267,000 to $329,000 for a four-room flat; and $335,000 to $406,000 for a five-room flat.

In line with HDB's plans to develop Punggol as an eco-town, Punggol Topaz is designed with eco-friendly features to receive Green Mark certification.

PropNex expects the attractive pricing of the flats to be the biggest pull factor for potential applicants.

Based on transactions handled by the property firm in November 2010, the prices for four-room and five-room flats in Punggol Topaz are 25 per cent and 19 per cent cheaper than prevailing resale prices.

'Despite the slight drop in median resale prices in Punggol since 3Q10, this still translates to a hefty price difference and greater affordability for the BTO flats in Punggol Topaz,' said PropNex corporate communications manager Adam Tan.

He expects strong demand for the new flats due to the current popularity of Punggol - even though the number of new flats introduced by HDB this year is at a high of almost 18,000.

Source: www.businesstimes.com.sg

Posted by IM at 3:09 PM

Labels: Build-to-order (BTO), HDB, hdb singapore, Property News, the Punggol Topaz

Capital Square may be put on the market soon

Published December 23, 2010

Capital Square may be put on the market soon

Grade A office block in Church Street could be worth around $900 million

By KALPANA RASHIWALA

CAPITAL Square, a Grade A office development at Church Street in the Raffles Place micromarket, is expected to be put up for sale soon. It could be worth about $900 million.

BT understands that Cushman & Wakefield will be appointed as marketing agent for the property. It was one of about four or five property consultants invited to make submissions under a Request for Proposal recently.

The property has a net lettable area of 386,525 sq ft, comprising a 16-storey office tower, two rows of conservation shophouses and over 360 car park lots. It is on a site with a remaining lease of about 84 years.

Capital Square is owned by Germany's Ergo Insurance Group and managed by MEAG Pacific Star Asset Management, a joint venture between Pacific Star Group and MEAG, which is asset manager of Munich Re and Ergo.

The building was developed by Keppel Land and Rodamco. The duo sold the property around late 2002 in a deal that valued the asset at $490 million to Ergo. That transaction was structured as an asset securitisation which raised $505 million through the issue of seven-year bonds. Market watchers recall that ahead of the bonds' maturity, Ergo had mulled a sale of the asset last year, but in the end opted for a $549 million refinancing deal which involved the issuance of notes arranged by Australia and New Zealand Banking Group.

BT understands that Cushman could be planning a tender or expression of interest exercise for the sale of Capital Square next month with a view to concluding a deal by April 2011.

Some industry players suggest that Capital Square, which was completed in 1998, could fetch about $2,300-2,400 per square foot, or about $889-928 million. They based this on the $2,400 psf achieved (excluding income support) for K-Reit Asia's and Suntec Reit's recent purchases of a one-third stake each in Marina Bay Financial Centre's Phase 1 (comprising two Grade A office towers, Marina Bay Link Mall and over 600 carpark lots).

'However, MBFC is a brand new development while Capital Square is 12 years old. There may also be space coming up for re-leasing from next year when some tenants move out,' points out one property consultant.

Major tenants at Capital Square include Citigroup, Morgan Stanley and Bloomberg. It boasts column-free floor plates of up to 30,000 sq ft for the office tower, among the biggest in the location.

'This is one of the better-quality office buildings in the Raffles Place area. The landlord could probably charge rentals today above $10 psf a month,' said an office leasing agent.

So far this year, about $8.8 billion worth of office investment sales deals have been done.

Besides K-Reit's and Suntec Reit's acquisitions of a one-third stake each in MBFC Phase 1, other major deals include DBS Towers ($870.5 million), Chevron House ($547.1 million) and GuocoLand's purchase of the site above Tanjong Pagar MRT Station with a minimum office component.

Source: www.businesstimes.com.sg

Posted by IM at 3:06 PM

Labels: Building Sale, Capital Square, singapore real estate

BTO project in Punggol launched

BTO project in Punggol launched

By S Ramesh | Posted: 22 December 2010 1234 hrs

SINGAPORE: The Housing & Development Board (HDB) has launched another Build-To-Order (BTO) project - the Punggol Topaz with 1,010 standard flats - in Punggol.

HDB said 95 per cent of the flat supply would be set aside for first-timer households.

With the launch on Wednesday, HDB would have offered a total of 17,713 new flats for sale under the BTO and Sale of Balance Flat exercise in 2010.

Punggol Topaz, located along Punggol Way and Punggol Field, comprises 184 units of three-room, 542 units of four-room and 284 units of five-room flats.

Facilities to be provided at this development include a supermarket, an eating house, shops, a child care centre, and a Residents' Committee Centre.

Other facilities available in Punggol town to serve the future residents include the nearby Punggol MRT/LRT station, bus interchange, and the future town centre.

The Tampines Expressway (TPE) and Kallang-Paya Lebar Expressway (KPE) are a short drive away, offering good connectivity to the rest of Singapore.

In line with HDB's plans to develop Punggol as an Eco-Town, Punggol Topaz is designed for Green Mark Certification, with eco-friendly features.

The layout of blocks and units is oriented to minimise heat gain from the sun.

It is designed with ecologically friendly features such as dry ponds and rain gardens that help to maintain the quality of surface runoff from rainwater before it is discharged into the drainage system.

The selling prices for the flats range from S$166,000 to S$207,000 for a three-room flat, S$267,000 to S$329,000 for a four-room flat and S$335,000 to S$406,000 for a five-room flat.

For 2011, HDB said it is prepared to launch up to 22,000 new BTO flats, if demand is sustained.

In the first quarter of next year, HDB will launch about 5,000 BTO flats. These BTO flats will be located in towns such as Bukit Panjang, Jurong West, Yishun and Sengkang.

The next BTO launch in January 2011 will offer 1,700 flats in Bukit Batok and Yishun.

- CNA/wk

Source:/www.channelnewsasia.com

Posted by IM at 8:17 AM

Labels: Build-to-order (BTO), HDB, Property News, the Punggol Topaz

Prime freehold landed home prices up 5.1% in Q4

by Travis Teo

05:55 AM Dec 22, 2010

SINGAPORE - Prices of freehold landed housing in Singapore's prime districts have surged 5.1 per cent in the fourth quarter from the previous three months, compared to growth of 2 per cent in the third quarter.

The average price of landed homes in the prime districts in the fourth quarter stands at $1,693 psf, property consultant DTZ said yesterday. Outside the prime districts, landed prices are up by 4.3 per cent to $993 psf, compared to the 1.7 per cent increase a quarter ago, it said.

Overall, DTZ says this represents an increase of about 16 per cent for landed properties for the whole of this year.

Ms Chua Chor Hoon, head of DTZ South East Asia Research, noted that the limited supply of landed properties, accounting for about 26 per cent of total private housing stock, made them a prized asset.

In contrast, the supply of non-landed units, such as condominiums, is injected at a faster pace via the government land sales programme and collective sales, she said.

The resale price of leasehold condominiums in the suburban areas has held firm at $660 psf this quarter, while that of condominiums in the prime districts grew marginally by 0.4 per cent to $1,520 psf. The prices of these two non-landed segments have surpassed their previous peaks in 2007, indicating price increases are hitting a resistance wall, DTZ said.

Buyers have also exercised greater prudence following the government's cooling measures implemented this year, it added.

Source: www.todayonline.com

Posted by IM at 6:54 AM

Labels: freehold condo, freehold landed Property, freehold residential property, landed Property, Property News

Landed homes' capital values rise faster than apartments, condos

Published December 22, 2010

Landed homes' capital values rise faster than apartments, condos

Average cap value of prime resale freehold landed homes up 5.1% in Q4

By KALPANA RASHIWALA

AVERAGE cap values of landed homes in Singapore have risen at a faster clip than those of private apartments/condos in the fourth quarter as well as the whole of this year, show latest figures from DTZ.

DTZ's analysis referred only to resale landed and non-landed homes, that is, properties that had already obtained Certificate of Statutory Completion.

'The limited stock of landed homes has made them prized assets, especially those in the prime districts. Landed homes currently account for about 26 per cent of Singapore's total private housing stock (including executive condos), with very limited supply in the pipeline. In contrast, the supply of non-landed private homes is injected at a faster pace via the Government Land Sales programme and collective sales,' says DTZ's Southeast Asia research head Chua Chor Hoon.

The average capital value of prime resale freehold landed homes stood at $1,693 per square foot (psf) on land area in Q4 2010, up 5.1 per cent from the previous quarter, taking the full-year increase to 17 per cent. For suburban freehold landed houses, the average capital value increased 4.3 per cent quarter on quarter to $993 psf in Q4, resulting in a full-year appreciation of 15.5 per cent.

In the non-landed segment, the average cap value for 99-year suburban condos remained unchanged at $660 psf on strata area in Q4 2010, taking the appreciation for the whole of 2010 to 8 per cent. The average price of prime freehold condos increased 0.4 per cent quarter on quarter to $1,520 psf in Q4, also reflecting an 8 per cent full-year price gain.

DTZ said prices in these two segments are hitting resistance, having risen by about 18 per cent and 36 per cent since their respective Q1 2009 troughs following the global financial crisis. The latest cap values are also above the respective Q4 2007 peak levels, it noted.

'Greater prudence is also being exercised on buyers' part following the latest property cooling measures introduced on Aug 30. Buyers are more selective and prefer projects with good location attributes such as proximity to MRT stations, schools or the central business district,' DTZ said.

On the other hand, the Q4 2010 average cap value of freehold luxury condos (above 2,500 sq ft) in the prime districts was $2,630 psf, about 6 per cent shy of the Q4 2007 peak of $2,800 psf. The latest Q4 figure was unchanged from the preceding three months while the full-year 2010 increase was 9.6 per cent.

'With a limited pool of buyers being able to afford these luxurious units which require a large quantum sum, this segment has seen more subdued purchasing activity,' DTZ said.

The firm's executive director (residential) Margaret Thean said: 'Although there's less activity in the high-end segment, we're still seeing strong interest from Chinese and Indian nationals, and increasingly from institutional investors such as funds. They have confidence in future price growth due to Singapore's strong economic fundamentals. As for individual foreigners buying for owner occupation, completed developments near renowned schools particularly interest them.'

Ms Chua predicts that resale prices of 99-year suburban condos are likely to remain flattish next year while those of prime freehold condos could rise by up to 5 per cent if there is more buying from foreigners due to the clampdown on property purchases in their home countries.

She expects prices of landed homes to continue to outperform those of apartments and condos due to their relative scarcity appeal.

Source: www.businesstimes.com.sg

Posted by IM at 6:49 AM

Labels: freehold residential property, landed Property, landed residential property, luxury condos, Property News, singapore real estate

HDB's one-millionth flat milestone

Published December 20, 2010

HDB's one-millionth flat milestone

By JOYCE HOOI

(SINGAPORE) The keys to the Housing and Development Board's (HDB) one- millionth flat were handed to its owners yesterday, at the completion ceremony of Treelodge@Punggol.

The development is the first eco-friendly precinct developed under the auspices of the HDB, which celebrated its 50th anniversary in February this year.

'In just 50 years, the HDB has built one million flats to house a nation. This is no mean feat, and few other countries can lay claim to such an outstanding achievement in so short a time,' said Teo Chee Hean, Deputy Prime Minister and Minister for Defence, during his speech as the ceremony's guest-of- honour.

Mr Teo is also an MP for the Pasir Ris-Punggol Group Representation Constituency (GRC).

The Treelodge@Punggol features an eco-deck above the carpark, a playground built from recyclable materials, and a rainwater collection system, among other things.