By UMA SHANKARI

THE Housing and Development Board (HDB) has launched a site at Clementi Avenue 4 for sale under its design, build and sell scheme (DBSS).

An estimated 770 flats can be built on the plot, which has a site area of 235,800 square feet and a maximum allowable gross floor area of 825,300 sq ft. The site carries a lease term of 103 years (including a four-year construction period).

Analysts expect a top bid in the range of $200-$250 per square foot per plot ratio (psf ppr) for the plot. This translates to an overall land cost of $165 million to $206 million.

'This is one of the more attractive sites offered under the DBSS scheme,' said Nicholas Mak, head of research at SLP International. 'It is close to Clementi MRT station. Clementi New Town is also becoming more vibrant, with new projects such as The Clementi Mall.'

While buying sentiment has significantly moderated in both the public and private housing sectors, participation from developers for this site is likely to be motivated by the project's physical strengths and opportunities, said Ong Kah Seng, Cushman & Wakefield senior manager of Asia-Pacific research.

'This site is likely to see moderate interest from developers, who are still interested in providing homes for this specific segment although generally, home-buying sentiments are expected to remain cautious in the months ahead,' Mr Ong said.

The last site offered for sale under the DBSS scheme, at Yuan Ching Road in Jurong, drew a top bid of $192 psf ppr. Six bids were submitted for the site.

The tender for this site will close at noon on March 8, 2011.

Last year, HDB sold five land parcels for DBSS development in Yishun, Bedok, Tampines, Hougang and Jurong West. These five land parcels will yield about 3,000 DBSS flats, and this pipeline supply will come on-stream progressively in 2011.

Another DBSS site at Pasir Ris Central, with an estimated yield of 460 units, will be launched for tender in March. More sites for DBSS development will be made available if there is sustained demand, HDB added.

Flats sold under DBSS are offered to buyers under HDB's eligibility conditions. But the developers who buy such sites have some flexibility in designing, pricing and selling the flats.

Source; www.businesstimes.com.sg

DBSS site at Clementi launched for sale

Posted by IM at 9:13 AM

Labels: Design Build and Sell Scheme (DBSS), HDB, HDB resale, hdb singapore, private housing sectors, Property News

Booklet of Mah Bow Tan's thoughts on housing

Booklet of Mah Bow Tan's thoughts on housing

By UMA SHANKARI

THE Ministry of National Development (MND) is publishing a booklet containing the musings of its minister, Mah Bow Tan, in a bid to reach out to more Singaporeans and explain housing policies.

In response to a query from BT, Mr Mah said that the booklet will contain nine commentaries that encapsulate his thoughts on Singapore's public housing programme over the past five decades.

This should give readers an insight into the thinking behind the policies that shape the system Singapore has today.

Said Mr Mah: 'Today, eight in 10 Singaporeans stay in HDB flats, and nine in 10 of them own the flats they live in. This is the highest home-ownership rate in the world. No other country comes close.

'But, public housing is not just about putting roofs over people's heads. It is also about building inclusive homes and communities.

'This has not been an easy effort. There is a finite budget to work with, and policy trade-offs to be made.

'With this booklet, I hope to reach out to more Singaporeans, to tell them about our ongoing housing story, and to enhance their understanding of the policy considerations behind this success story,' he added.

The booklet will be released in either February or March this year.

MND plans to distribute the booklets to relevant entities such as HDB branch offices, town councils, public libraries, and academic institutions.

In addition, the booklet could be sold in selected bookstores.

It might also be available in a Mandarin version, sources said.

Source: www.businesstimes.com.sg

Posted by IM at 3:00 PM

Labels: HDB, hdb singapore, Mah Bow Tan, MND, Public Housing

DBSS site at Clementi launched for sale

Published January 26, 2011

DBSS site at Clementi launched for sale

By UMA SHANKARI

THE Housing and Development Board (HDB) has launched a site at Clementi Avenue 4 for sale under its design, build and sell scheme (DBSS).

An estimated 770 flats can be built on the plot, which has a site area of 235,800 square feet and a maximum allowable gross floor area of 825,300 sq ft. The site carries a lease term of 103 years (including a four-year construction period).

Analysts expect a top bid in the range of $200-$250 per square foot per plot ratio (psf ppr) for the plot. This translates to an overall land cost of $165 million to $206 million.

'This is one of the more attractive sites offered under the DBSS scheme,' said Nicholas Mak, head of research at SLP International. 'It is close to Clementi MRT station. Clementi New Town is also becoming more vibrant, with new projects such as The Clementi Mall.'

While buying sentiment has significantly moderated in both the public and private housing sectors, participation from developers for this site is likely to be motivated by the project's physical strengths and opportunities, said Ong Kah Seng, Cushman & Wakefield senior manager of Asia-Pacific research.

'This site is likely to see moderate interest from developers, who are still interested in providing homes for this specific segment although generally, home-buying sentiments are expected to remain cautious in the months ahead,' Mr Ong said.

The last site offered for sale under the DBSS scheme, at Yuan Ching Road in Jurong, drew a top bid of $192 psf ppr. Six bids were submitted for the site.

The tender for this site will close at noon on March 8, 2011.

Last year, HDB sold five land parcels for DBSS development in Yishun, Bedok, Tampines, Hougang and Jurong West. These five land parcels will yield about 3,000 DBSS flats, and this pipeline supply will come on-stream progressively in 2011.

Another DBSS site at Pasir Ris Central, with an estimated yield of 460 units, will be launched for tender in March. More sites for DBSS development will be made available if there is sustained demand, HDB added.

Flats sold under DBSS are offered to buyers under HDB's eligibility conditions. But the developers who buy such sites have some flexibility in designing, pricing and selling the flats.

Source: www.businesstimes.com.sg

Posted by IM at 7:18 AM

Labels: Design Build and Sell Scheme (DBSS), HDB, hdb singapore, residential property

HDB launches 3 BTO projects with 1,728 flats

Published January 26, 2011

HDB launches 3 BTO projects with 1,728 flats

Bt Batok project will have 180; projects in Yishun will have total of 1,548 units

By UMA SHANKARI

THE Housing & Development Board (HDB) yesterday launched for sale three more build-to-order (BTO) projects - one at Bukit Batok and two at Yishun - with a total of 1,728 standard flats.

The Bukit Batok project, Golden Daisy, will comprise solely of 180 studio apartments which will sell for between $83,000 and $118,000 each.

The two projects in Yishun - Orchid Spring @ Yishun and Vista Spring @ Yishun - offer a mix of two-room, three-room, four-room and five-room flats. Orchid Spring @ Yishun, located along Yishun Avenue 11, will have 948 units while the adjacent Vista Spring @ Yishun offers 600 flats.

Prices at the two projects range from $93,000 to $112,000 for a two-room flat; $150,000 to $183,000 for a three-room flat; $230,000 to $278,000 for a four-room flat; and $292,000 to $353,000 for a five-room flat.

Analysts said the attractive pricing of the Yishun flats would be a draw and expect that over-subscription rates for the projects could be as high as five times. The two projects are located in the same vicinity as a sold-out private condominium project, The Estuary.

'Pricing is attractive when compared to resale flats in the same locality that are about 22-24 years old. The new three-room flats are 30-40 per cent cheaper, while the four-room and five-room flats are 7-12 per cent and 16-21 per cent cheaper respectively,' said ERA's key executive officer Eugene Lim.

The flats at Yishun are clearly targeted at young couples and families, analysts said. Besides playgrounds, fitness stations and a jogging track, Orchid Spring even boasts a child care centre within the development itself.

By contrast, the 180 units at Golden Daisy are meant for senior citizens, observed PropNex corporate communications manager Adam Tan. But the apartments are not likely to be keenly contested for as studio apartments are never in very high demand, Mr Tan added.

HDB has ramped up its new flat supply significantly to meet the demand from first-timer households.

This year, the agency will offer up to 22,000 new flats under its BTO scheme if demand is sustained. This is 24 per cent more than the 17,700 flats offered for sale under the BTO scheme and sale of balance flats exercise in 2010.

In the first six months of 2011, about 11,000 new BTO flats will be offered. The upcoming projects will have a good geographical spread in towns such as Bukit Panjang, Jurong West, Punggol, Sengkang and Yishun, HDB said.

Source: www.businesstimes.com.sg

Posted by IM at 7:14 AM

Labels: Build-to-order (BTO), Golden Daisy, HDB, hdb singapore, Orchid Spring, Vista Spring

Revisiting housing supply

Based on URA and HDB projections, there could be a deluge of homes in 2013 and 2014

by Ku Swee Yong

05:55 AM Jan 07, 2011

It was a week before last Christmas when we celebrated the Housing and Development Board's (HDB) completion of 1 million flats.

This is an awesome achievement. With 1 million flats averaging about 1,000 sq ft each, the HDB has within 50 years completed and handed over a billion sq ft of residential space. A billion sq ft. One, followed by nine zeros. That is more square footage than the above-ground portion of the Great Wall of China, which spans 6,500km.

Now, the actual number of HDB flats that exist today is just below 900,000. According to the HDB's annual report, as of March 31, 2010, there were 890,212 flats under management. More than 100,000 flats have been demolished since the '70s, many of them rental flats. Older estates, such as Brickworks and Queenstown, have been upgraded.

Over the years, small individual estates have also been amalgamated into towns such as Bukit Merah Town, Clementi New Town, etc, under various estates renewal programmes, such as Selective En bloc Redevelopment Scheme (Sers).

The completion of an average of 20,000 flats per year in the HDB's 50-year history was in tandem with the growth of Singapore's population.

In the last 15 years, from 1995 to 2010, population growth (Singaporean citizens and permanent residents) averaged 50,000 per year, accommodated by the growth of public (additional 13,950 flats a year) and private housing (8,593 units a year). This is an average of one apartment for every two to three Singapore citizens and PRs. If we included non-residents (Work Permit and Employment Pass holders, for example), then this is an average of one new HDB or private home for every four new people added to the "headcount" in Singapore.

Table 1 shows the actual supply of physical units versus population growth. The 15-year data looks balanced.

However, within the 15 years, there were several tumultuous periods. Early on, a long queue of up to five years for HDB flats formed due to a perception of supply shortage and rising prices. Executive Condominiums were introduced.

The massive construction boom around 1995, with fuel added by en-bloc deals, led to a massive increase of 44,000 residential units per year in the period spanning 1998 to 2000. This is net additional physical supply; that is, demolitions from en-bloc deals have reduced the total count.

THE SCOURGE OF SARS

The economy dipped in 2001 after the dotcom crash, which was followed by 911, Gulf War II, the Bali bomb blast, and then Sars. The blip during the Sars crisis was the worst: A recession with a population exodus of 61,000 in 2003, during which there was an accumulated excess of residential units.

By March 2004, HDB announced it would stop building five-room flats because it had 10,000 units that were waiting to be taken up. At that time, three-bedroom private apartments could easily be had at $500,000 and there was little demand from a population that shrank by 61,000.

The over-supply, apparent since 2001, brought on a revamp of the HDB and the introduction of the Build-To-Order (BTO) scheme. HDB flats will be constructed only when there are enough buyers, allowing the board to adjust supply based on demand from applicants.

In 2002, the registration for flats system was suspended and till today, the BTO scheme remains the main mode of HDB's sales. The Design, Build and Sell Scheme (DBSS) was introduced in 2005 for private sector developers to participate in public housing projects. This scheme contributes about 10 per cent of total new HDB supply.

The period of 2004 to 2005 was one of slow growth as there was excess supply which had to be absorbed by new demand from the population growth before equilibrium could be reached. Government Land Sales slowed down, leading to the next squeeze.

MARKET RECOVERS AMID EN-BLOC FEVER

From 2006 to 2008, real estate prices recovered on a combination of factors, including: (a) rapid population growth on the back of strong jobs creation; (b) rosy economic outlook spurred by the promise of the integrated resorts; (c) developers replenishing freehold land bank through en bloc transactions and (d) small number of project starts in 2003 to 2005 leading to low completion numbers in 2006 to 2008.

Of the above factors, the en bloc phenomenon created the biggest squeeze because it (a) demolished physical housing units to make way for redevelopment, reducing total stock; (b) put millions of dollars of windfall into the hands of the en bloc sellers, amplifying purchasing power, and (c) en bloc sellers had to buy another property for their own stay at a time when net new supply was already low.

The average growth of population in the last five years - from 2006 to last year - was 162,000 per year. The demand for housing was way higher than the net supply growth of private residential at 5,780 units per year and the additional supply of 2,129 HDB flats per year, partly due to Sers rejuvenation of older estates. The timing could not have been better.

If we narrowed our analysis down to the numbers for 2006 to 2008, the shortage of space is even more pronounced. Vacancies dropped to a low of around 4 per cent as the average annual increase of 4,077 units of private residential stock (TOP completions minus en bloc demolitions) and 1,858 units of HDB stock were hardly enough for the influx of population at 191,200 a year! Assuming the new population agreed to squeeze into residential units 10 people at a time, we would need a supply of 19,100 units each year in 2006 to 2008. But the additional stock count was only 5,935. So naturally, rentals and capital values spiked.

SUPPLY OUTLOOK

We need to look at the planning for physical supply and not merely the real estate market based on launches and pre-sales. Some schools of thought favour the idea that, in land-scarce Singapore, property investors merely care about capital gains, not the steady rental income stream. For me, I stress the importance of long-term returns from real estate and therefore, I keep a close eye on physical supply and asset utilisation.

A property has real value only when it is well-used. Most hard, capital-intensive assets are like that: Ships, aeroplanes, machinery, satellites, ports, highways, and so on. If you leaned towards feng shui, you would also believe that the higher the human traffic and goods flow (especially for industrial, retail and commercial properties), the better the property.

An over-supply of completed residential properties, with insufficient end-users and poor utilisation, would naturally lead to price weakness.

Conversely, insufficient supply or too-rapid a population or demand growth will lead to sky-rocketing prices - similar to the situation in 2007. This would not go down well with our central planners. Despite being a top-notch economy, Singapore does not like to price itself out of the market. So, we can expect more supply to quench the fire of rising prices.

Since the middle of 2009, public housing demand has been robust and prices have moved up sharply. From Table 2, we see that HDB launches of BTOs were ramped up significantly last year.

According to the HDB: "The ramp-up of flat supply is part of a series of additional measures to reinforce the Government's commitment to provide affordable and adequate public housing supply for first-timer households." If demand remains strong, the HDB may launch up to 22,000 BTO flats and release land for 7,000 DBSS units this year. That's a potential 29,000 HDB units. That's huge.

However, the numbers do not indicate when the physical supply will be completed. The HDB supplies new flats based on various demand factors, such as new households formed from marriages, number of resale transactions, etc. To satisfy the strong demand and in order to shorten the waiting time for first-time buyers, Mr Mah Bow Tan, the Minister for National Development, has announced that the HDB will endeavour to complete construction within two-and-a-half years, shorter than the previous average of three years, for all BTOs starting from September last year.

Based on the above information, public housing supply is estimated to be as shown in Table 3:

If we net out the number of HDB units that may be demolished for estate renewal, the supply looks comfortable, especially since most of the BTO flats have found owners before construction began.

However, if we look at the total supply of residential units (both HDB and private) as shown in Table 4, the numbers become somewhat scary.

If you recall from Table 1 above, the 15-year average annual supply is about 22,000 units of HDB and private housing. The recent record high Government Land Sales programme and the ramp up of HDB supply may lead to a supply of over 30,000 units in 2013 and 43,000 units in 2014.

The last time so many residential units were completed was during the period of 1998 to 2000, when an average 44,000 units were completed per year. That was a supply level that was challenging to absorb as new family formations through marriages tracked at around 25,000 per year and thepopulation increased at 70,000 per year. And not all newly-weds purchase homes or move out of their parents' nests, while new population may come in the form of students or contract workers who occupy dormitories rather than residential units.

That period of over-supply led to a long period of indigestion from 2002 to 2005, when prices stagnated on the back of an economy hit by Sars and external turbulence. Vacancies of private residential units hovered above 8 per cent for most of 2002 to 2005, much higher than the 5 to 6 per cent of 2009-2010.

WHAT MIGHT BE THE LEVERS TO PULL?

Should the Urban Redevelopment Authority's projections of residential completions be accurate and HDB supply remains high, we must brace ourselves for a deluge in 2013 and 2014. We are now in 2011, so that gives us over a year to prepare. There are, however, a few ways that may mitigate the over-supply threat:

- Speeding up estate renewal programmes

By 2015, there will be more than 200,000 flats that will be over 30 years old. Old flats could be torn down sooner. Current tenants will be given notice to move out into other HDB flats. However, HDB's pace of renewal programmes is not entirely clear to market watchers, so I would not be able to take a stab here.

- Slowing down construction

The HDB can choose to slow down the supply of new flats. In the case of BTOs, the process of applications, queueing, balloting, selection, etc, and then contracting the construction companies to build are within the control of HDB. If physical supply is high and vacancies increase, the completion of construction could be delayed for the market to take up some slack.

- Embracing more foreigners

The demand side of the equation could be jacked up by welcoming more foreigners to our shores. This is especially so if the economic growth in the next five years can hold up at 5 per cent or higher, ensuring that jobs growth will be robust. If executed well, an increase in housing demand produces the best outcome for the whole market.

It remains to be seen if the large supply can be supported by demand. It is critical for stakeholders to make informed decisions, thinking through a comprehensive set of real estate data such as housing demolitions, population growth policies, public and private housing TOPs, etc, to the extent that such information is available.

The writer is the founder of real estate agency International Property Advisor (IPA), which provides services to high-net-worth individuals.

Soure: www.todayonline.com

Posted by IM at 1:29 AM

Labels: Build-to-order (BTO), Design Build and Sell Scheme (DBSS), en bloc, HDB, hdb singapore, Property News, Redevelopment Scheme

Luxury home prices defy market lethargy

Published January 4, 2011

Luxury home prices defy market lethargy

Overall price growth for private homes, HDB resale flats slowed in Q4 but high-end hit new high

By UMA SHANKARI

(SINGAPORE) A surge of interest in high-end and luxury homes pushed prices in the segment, which has underperformed the rest of the market over the last two years, to a fresh all-time high in Q4 2010.

But in the rest of the market, prices of private homes as well as HDB resale flats grew more slowly in the fourth quarter compared to the first three quarters of last year.

Flash estimates released by the Urban Redevelopment Authority (URA) yesterday show that overall private housing prices edged up 2.7 per cent in Q4 to a fresh record high.

Private home prices in Singapore first surpassed the former all-time peak achieved in 1996 in Q2 2010, and then continued to inch upwards in Q3 and Q4. For the whole of 2010, prices climbed 17.6 per cent.

But the gain in fourth-quarter prices was the smallest in six quarters, URA's data shows.

The high-end market was a notable exception. Non-landed home prices in the Core Central Region (CCR) micro-market, which includes the prime districts Marina Bay and Sentosa Cove, rose 2.3 per cent in Q4, faster than the 1.6 per cent growth seen in Q3.

This pushed luxury home prices to a new all-time high, outstripping the previous peak in Q1 2008.

By contrast, the price index for Rest of Central Region (RCR) rose by 1.7 per cent in Q4, down from 2.3 per cent in Q3. And in the Outside Central Region or OCR (where suburban condos are located), prices climbed 1.6 per cent in Q4 after increasing 2.2 per cent in Q3.

Analysts attributed the slowdown in price growth in the RCR and OCR areas to resistance from buyers for increasingly expensive projects.

Price growth in the CCR region, by contrast, rose on the back of the prevailing strong economy and low interest rates, which once again enticed foreign investors to pick up luxury homes in Singapore.

'In 2010, much of the activity was focused on the mass and mid-market segments,' said Joseph Tan, CBRE's executive director for residential. 'Foreigners stayed away, thinking that the lack of transaction activity in the high-end segment would lead to a fall in prices and allow them to buy the properties for less.'

But since most high-end home owners proved to have 'holding power', the anticipated fall in luxury home prices did not occur and foreign buyers are slowly returning to the luxury market, Mr Tan said.

The number of foreign home buyers rose by 14 per cent in 2010 compared to 2009, said Knight Frank's head of consultancy & research Png Poh Soon.

'The tightened regulations in Hong Kong and aggressive anti-speculation rules in China caused some investors to shy away from those markets and directed them to Singapore,' Mr Png said. 'High net worth foreign buyers would definitely consider the Singapore property market to park their money.'

Analysts also noted that while the latest round of cooling measures introduced by the government on Aug 30 have not dampened transaction volumes, they appear to have at least moderated price growth. A record 15,500-16,500 new private homes are estimated to have been sold in 2010, despite demand-side and supply-side measures introduced periodically throughout the year.

CBRE's Mr Tan said that transaction volumes were still high in 2010 as many potential buyers are still out looking for units.

But the price growth has slowed as these buyers - especially those house-hunting in the mass-market segment - are sticking to a budget.

Over at the HDB market, prices of resale flats rose 2.4 per cent in Q4 2010 - a slower rate of growth than the 4 per cent increase in Q3 2010 - according to flash estimates from the Housing & Development Board.

But while the resale price index was pushed to yet another all-time record, the transaction volume fell.

The resale volume declined by about 21 per cent in Q4, HDB said. And the median cash-over-valuation (COV) amount is also estimated to have fallen by $7,000 or 23 per cent, from $30,000 in Q3 2010 to $23,000 in Q4 2010.

In fact, COV levels declined progressively over the last three months of 2010, according to data from PropNex.

The firm's chief executive, Mohamed Ismail, said that according to monthly transactions handled by his company in Q4 2010, the median COV fell from $26,000 in October to $23,000 in November and to $20,000 in December.

But overall resale prices are still climbing in spite of falling COV levels due to a time lag, he explained

'Valuations for resale flats that were transacted in Q4 2010 were based on prevailing caveats for flats in the vicinity,' Mr Ismail said.

'There is therefore a certain lag time of about two months and hence the (HDB) prices overall are still climbing.'

Looking ahead, growth in private home prices may slow to anywhere between 3 per cent and 10 per cent in 2011, analysts predicted.

But most are more bullish on luxury home prices, which some said could climb by up to 15 per cent this year.

In the mass-market segment, the ample supply of new homes coming onstream from the beefed-up 2010 Government Land Sales programme should help to keep price growth to less than 5 per cent, analysts said.

And in the HDB resale market, prices are expected to grow by 5-10 per cent in 2011. The overall median COV level should also fall to about $18,000 to $20,000 in Q1 2011, said Mr Ismail.

Source: www.businesstimes.com.sg

Posted by IM at 3:10 PM

Labels: HDB resale, hdb singapore, luxury condos, luxury residences, Property News

Honey, I shrunk the flat, but it's just us now

Honey, I shrunk the flat, but it's just us now

HDB flats are smaller than before but may provide more space as families shrink

By EMILYN YAP

Top Print Edition Stories

Published December 30, 2010

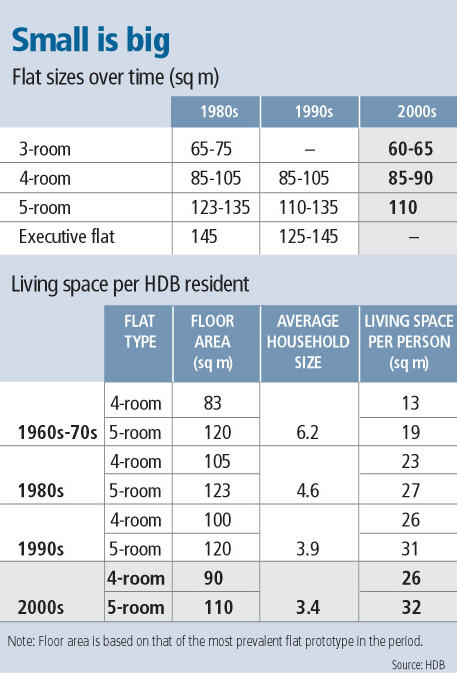

(SINGAPORE) HDB flats have gotten smaller over the years, but most occupants today should actually have more space to themselves as the size of families has also shrunk.

Data that BT obtained from HDB reflects this trend. From the 1980s to 2000s, all types of flats have been scaled down. The changes appear most noticeable between the 1990s and the 2000s.

For instance, a five-room flat built in the last 10 years would measure around 110 square metres, but an older one from the 1990s would be 110-135 sq m, while another hailing from the 1980s would measure some 123-135 sq m.

HDB explained that it 'reviews flat sizes regularly, taking into consideration changes in demographic trends and lifestyle habits, as well as the need to optimise limited land available for housing'.

Home hunters have noticed the change in flat sizes. The difference stands out particularly to those who have been shopping for resale flats across estates, said Dennis Wee Group director Chris Koh.

PropNex chief executive Mohamed Ismail agreed that flats have become smaller in the last 20 to 30 years, but pointed out that there has also been a more 'efficient use of space'.

For instance, most new flats no longer come with large balconies and long corridors. In addition, glass panels have become an increasingly common feature because they create a sense of spaciousness, he said.

While HDB's data confirms that flats have become more compact, it also highlights something less obvious to the casual observer - many residents today should have more living space because their families are smaller.

According to official surveys, the average household size was 3.4 in the 2000s and 4.6 in the 1980s. This means that an occupant in a relatively new 110 sq m five-room flat is likely to have 32 sq m of space to himself, while someone living in a 123 sq m five-roomer in the 1980s probably had just 27 sq m of space.

'Over the years, while flat sizes have been adjusted, living space per person has improved for HDB residents as household size has decreased . . . due to the nuclearisation of families and formation of smaller families,' HDB said.

HDB 'will continue to provide a wide variety of flats and ensure that flat sizes are reviewed regularly to cater to prevailing and future needs'.

Property agents note that flat sizes alone do not influence homebuyers' decisions - other factors such as location and amenities come into play.

As Mr Ismail shared, many people are looking forward to waterfront living in Punggol, even though flats in the area are likely to be smaller than those in older estates such as Yishun. 'The environments cater to different needs. There are pros and cons,' he said.

Still, industry watchers are not keen - and do not expect - to see flats getting smaller as they have to accommodate families.

'There's very little that you can cut back on, unless you want to cut back on the yard area . . . As it is, the room sizes are just nice,' Mr Koh said.

In the private housing sector, condominium units have also shrunk in size. The trend picked up pace from early 2009 when projects with a large proportion of shoebox units measuring less than 500 sq ft started to emerge. Developers have an incentive to keep units small so that they remain affordable even if prices in per square foot terms are high.

BT reported recently that the authorities have been projecting housing supply in the Government Land Sales programme by using smaller estimates for the average size of non-landed homes.

Market watchers do not believe that HDB flats will go the way of shoebox apartments. These private projects 'cater to investors who want to own a second property or to a single who wants to buy . . . but public housing is for a family nucleus', Mr Ismail said.

Source: www.businesstimes.com.sg

Posted by IM at 2:42 PM

Labels: HDB, hdb singapore, Property News, residential property, shoebox apartment, singapore property, singapore real estate

Housing a nation - today and tomorrow

by Mah Bow Tan

05:55 AM Dec 24, 2010

When Kit Chan performed Home at this year's National Day Parade, she struck a chord with many in the crowd, including me. This is my home. This is where people can "build our dreams together". This is what "will stay within me, wherever I may choose to go".

Over the last few months, in this series of articles, I have explained how the Government strives to foster a sense of home and belonging for all Singaporeans through a massive public housing programme. In this final column, let me sum up how the Housing & Development Board delivers this housing commitment in three ways: Homes for the masses, home ownership and homes for life.

HOUSING FOR HOMEBUYERS

Homes for the masses: The HDB builds and prices flats to achieve home ownership for the masses. Unlike some other countries where public housing caters to the poorest minority, the HDB's mission is to house the masses so that we can build an inclusive nation. But we face two growing challenges.

As we become a nation of home owners, demand from flat buyers - many with existing homes - has grown more volatile and sentiment-driven. Oversupply is as worrying as undersupply. Therefore, the HDB moved to the current Build-To-Order system, so that its new flat supply can respond to demand changes, while keeping a small buffer for contingencies.

As Singapore progresses, the people's aspirations are also rising and becoming more diverse. While standard flats will continue to form the bulk of new flat supply, the HDB has to build different flats for different budgets and aspirations, so that public housing remains an inclusive home for Singaporeans.

Home ownership: This is the second hallmark of our housing system. We provide homes for ownership, rather than for rent, so that Singaporeans have a clear stake in the country's prosperity. But even as flats appreciate in value to the benefit of home owners, housing must remain affordable for first-time buyers. The HDB therefore sets aside new BTO flats for first-timers and prices them at a substantial subsidy relative to market value. The HDB also provides housing grants for first-timers to buy resale flats. This helps to ensure affordability and equity in subsidies.

Today, nine in 10 residents own their HDB flats and about 15,000 young couples become home owners every year. Beyond international measures like the Home Price Index (HPI) and the Debt Service Ratio (DSR), our high ownership rate is the clearest indicator that flats remain affordable for first-timers. Most couples buying new flats use only 20 to 25 per cent of their monthly income through CPF contributions to pay for their housing loans, without any cash.

For the minority who cannot readily afford to own flats, public rental flats represent the final safety net. Even then, the HDB and social agencies strive to help these families improve their situations so that home ownership remains a long-term hope for them.

HOUSING FOR HOME OWNERS

Homes for life: The HDB takes a life-cycle approach to its relationship with residents. It helps young couples buy their first homes. It rejuvenates the homes and estates of the existing 900,000 home owners. It also helps older home owners right-size their homes for retirement while they remain staying within their community. Ultimately, HDB flats are not only homes but also an asset whose value can be unlocked, if needed.

Rejuvenating our homes: By 2015, more than 200,000 flats will be at least 30 years old. For older flats to remain attractive and sustain their value for home owners, the HDB embarked on a massive estate renewal programme since the '90s, focusing on Main Upgrading, Interim Upgrading, and Lift Upgrading (LUP).

Since 2007, estate renewal has taken on a larger dimension under the "Remaking Our Heartland" programme. This goes beyond upgrading works by HDB and pulls together efforts by different agencies to give an entire town a makeover. We will breathe new life into the heartlands by injecting new housing, rejuvenating town centres and developing new amenities and recreational areas. These include park connectors, cycling paths, heritage trails, and Active, Beautiful and Clean Water features.

In addition to enhancing the value of HDB flats, rejuvenation must focus on making towns more sustainable. Sustainability is about being able to use our land, energy and water more effectively as well as reducing waste. Punggol will be developed as our first eco-town. Lessons learnt there will be drawn for use in existing towns.

Right-sizing our homes: By 2030, one in five residents are expected to be aged 65 and above. Our HDB estates and policies must prepare for the different needs of elderly home owners. The HDB has begun to upgrade our physical environment to be more elder-friendly. All estates will be barrier-free by next year. The LUP is also on track to provide 100 per cent lift access to all eligible blocks by 2014.

As our population ages and family sizes shrink, Singaporeans may face less family support in their old age. Some may want to right-size and unlock their housing asset. HDB has put in place various options. Under the Lease Buyback Scheme, elderly home owners can receive a long-term income stream without uprooting from their surroundings. Elderly flat owners can also rent out spare rooms or whole flats for income, as their children grow up and move out. The elderly can also choose to right-size and buy studio apartments that are better equipped for their needs.

Building cohesive communities: Besides looking after individual home buyers and owners, the HDB's larger mission is to build cohesive communities. The HDB experience is an important part of the Singapore story where people of different backgrounds, ethnicities and incomes live harmoniously together as a community.

This is why the HDB spends considerable effort on planning our estates, down to the layout of blocks, precincts and neighbourhoods. HDB void decks, playgrounds and precinct pavilions are just some of the spaces carefully designed for residents to mix and mingle as part of their daily routine.

HOMES WHERE WE BELONG

When the HDB was formed in 1960, its pressing challenge then was to solve the huge housing shortage for Singaporeans. Fifty years on, the HDB has succeeded beyond expectations and received numerous international accolades for its achievements. I am thankful for the selfless contributions of the many men and women in the HDB through the years who have made it possible.

What about the next 50 years and beyond? Clearly, the focus of the HDB's challenge will evolve. Besides providing attractive and affordable flats for new homebuyers, the HDB's greater challenge will be to sustain the quality of life, community bonds and value that HDB flats bring to home owners, even as our estates mature.

While the challenges in the next phase will be different, the HDB's core mission of building homes and bringing hope of a better life for hardworking Singaporean families remains unchanged. With the continued support of other agencies, community leaders, and residents, I am confident that we can build an even better home for all - one where "we'll build our dreams together. Just like we've done before".

To all those who have followed this series of articles and given me comments, feedback and suggestions, let me say a sincere "thank you". I am also grateful to Today for providing me this platform to engage Singaporeans on this very important subject. Finally, I wish everyone season's greetings and a very happy and successful 2011.

The writer is the Minister for National Development. This is the last of nine commentaries that he has written exclusively for Today.

Source: www.todayonline.com

Posted by IM at 7:18 AM

Labels: HDB, HDB resale, hdb singapore, Mah Bow Tan, Property News, residential property, singapore real estate

2010's last BTO project launched in Punggol

by S Ramesh

05:55 AM Dec 23, 2010

SINGAPORE - The Housing and Development Board (HDB) has launched its last Build-To-Order (BTO) project for this year, the Punggol Topaz, with 1,010 standard flats. With the launch yesterday, the HDB would have offered 17,713 new flats under the BTO and Sale of Balance Flat exercise this year.

Punggol Topaz, located along Punggol Way and Punggol Field, comprises 184 three-bedroom units, 542 four-bedroom and 284 five-bedroom flats, with 95 per cent of the flats set aside for first-timers. The facilities there will include a supermarket, an eating house, shops, a child care centre and a Residents' Committee Centre.

The Punggol MRT/LRT station, bus interchange and future town centre are nearby. Tampines Expressway and Kallang-Paya Lebar Expressway are a short drive away.

In line with the HDB's plans to develop Punggol as an eco-town, Punggol Topaz is designed for Green Mark Certification.

The layout of blocks and units is oriented to minimise heat gain from the sun. It will have features such as dry ponds and rain gardens, which help to maintain the quality of surface run-off from rainwater before it is discharged into the drainage system.

Selling prices for the flats range from $166,000 to $207,000 for three-bedroom units, $267,000 to $329,000 for four-bedroom and $335,000 to $406,000 for five-bedroom flats.

PropNex corporate communications manager Adam Tan said: "Compared with our transactions in PropNex for November 2010, the prices for the 4-room and 5-room flats in Punggol Topaz are 25 per cent and 19 per cent cheaper than prevailing resale prices."

Next year, the HDB is prepared to launch up to 22,000 new BTO flats, if demand is sustained. It will launch about 5,000 BTO flats - in towns such as Bukit Panjang, Jurong West, Yishun and Sengkang - in the first quarter.

The next BTO launch in January will offer 1,700 flats in Bukit Batok and Yishun.

Source: www.todayonline.com

Posted by IM at 6:55 AM

Labels: Build-to-order (BTO), HDB, hdb singapore, Property News, singapore real estate, the Punggol Topaz

HDB launches 1,010 BTO flats in Punggol

Published December 23, 2010

HDB launches 1,010 BTO flats in Punggol

By UMA SHANKARI

THE Housing & Development Board (HDB) yesterday launched another 1,010 new flats for sale in its latest build-to-order (BTO) project, Punggol Topaz.

Including this launch, HDB has now offered a total of 17,713 new flats for sale under its BTO and sale of balance flat exercises in 2010, it said.

And the agency will continue to roll out new supply at a steady rate next year. It plans to launch about 5,000 new BTO flats in the first quarter of 2011, including 1,700 flats in Bukit Batok and Yishun in January.

For the whole of 2011, HDB is prepared to launch up to 22,000 new BTO flats if demand is sustained, it said.

Punggol Topaz, located along Punggol Way and Punggol Field, comprises 184 three-room, 542 four-room and 284 five-room standard flats. Some 95 per cent of the flat supply will be set aside for first-timer households.

Selling prices range from $166,000 to $207,000 for a three-room flat; $267,000 to $329,000 for a four-room flat; and $335,000 to $406,000 for a five-room flat.

In line with HDB's plans to develop Punggol as an eco-town, Punggol Topaz is designed with eco-friendly features to receive Green Mark certification.

PropNex expects the attractive pricing of the flats to be the biggest pull factor for potential applicants.

Based on transactions handled by the property firm in November 2010, the prices for four-room and five-room flats in Punggol Topaz are 25 per cent and 19 per cent cheaper than prevailing resale prices.

'Despite the slight drop in median resale prices in Punggol since 3Q10, this still translates to a hefty price difference and greater affordability for the BTO flats in Punggol Topaz,' said PropNex corporate communications manager Adam Tan.

He expects strong demand for the new flats due to the current popularity of Punggol - even though the number of new flats introduced by HDB this year is at a high of almost 18,000.

Source: www.businesstimes.com.sg

Posted by IM at 3:09 PM

Labels: Build-to-order (BTO), HDB, hdb singapore, Property News, the Punggol Topaz

HDB's one-millionth flat milestone

Published December 20, 2010

HDB's one-millionth flat milestone

By JOYCE HOOI

(SINGAPORE) The keys to the Housing and Development Board's (HDB) one- millionth flat were handed to its owners yesterday, at the completion ceremony of Treelodge@Punggol.

The development is the first eco-friendly precinct developed under the auspices of the HDB, which celebrated its 50th anniversary in February this year.

'In just 50 years, the HDB has built one million flats to house a nation. This is no mean feat, and few other countries can lay claim to such an outstanding achievement in so short a time,' said Teo Chee Hean, Deputy Prime Minister and Minister for Defence, during his speech as the ceremony's guest-of- honour.

Mr Teo is also an MP for the Pasir Ris-Punggol Group Representation Constituency (GRC).

The Treelodge@Punggol features an eco-deck above the carpark, a playground built from recyclable materials, and a rainwater collection system, among other things.

Residents will also have a car sharing scheme at their disposal, which will include hybrid cars as well.

An additional centralised refuse chute for recyclables has been introduced for each block, in order to promote more waste recycling.

'It's something new. There were no other HDB flats that were indicated as eco-friendly then, and we were quite excited to get it,' said Christina Ng, the owner of the one-millionth flat, a four-room unit.

Ms Ng and her husband, Wang Weiji, balloted for the flat in 2007 and are first-time homeowners. They plan to move in after the Chinese New Year.

The development was launched in 2007 with seven blocks of 712 flat units in total, comprising three-, four-, and five-room flats.

Year-to-date, 3,300 new flats have been launched in Punggol by the HDB and another 1,000 new flats are due to be launched over the next few days.

'If demand remains strong, HDB is on track to complete 35,000 flats by the end of 2015,' said Mr Teo.

Last month, the HDB launched the tender for the first mixed commercial-residential site at Punggol Town Centre, which will be next to the Punggol Waterway and Punggol MRT station.

'The HDB story is also the story of hope and social mobility in Singapore,' said Mr Teo.

'Singaporeans know that if they work hard and budget wisely, they can aspire to upgrade to a better flat and a better life.'

In 2008, the HDB won the United Nations Public Service Award for its Home Ownership Programme.

This was followed by the UN-Habitat Scroll of Honour Award 2010, which was given to the HDB for 'providing one of Asia's and the world's greenest, cleanest, and most socially conscious housing programmes'

Source: www.businesstimes.com.sg

Posted by IM at 6:40 AM

Labels: HDB, hdb singapore, Property News, singapore property, Treelodge at Punggol

HDB's one-millionth flat milestone

Published December 20, 2010

HDB's one-millionth flat milestone

By JOYCE HOOI

(SINGAPORE) The keys to the Housing and Development Board's (HDB) one- millionth flat were handed to its owners yesterday, at the completion ceremony of Treelodge@Punggol

The development is the first eco-friendly precinct developed under the auspices of the HDB, which celebrated its 50th anniversary in February this year.

'In just 50 years, the HDB has built one million flats to house a nation. This is no mean feat, and few other countries can lay claim to such an outstanding achievement in so short a time,' said Teo Chee Hean, Deputy Prime Minister and Minister for Defence, during his speech as the ceremony's guest-of- honour.

Mr Teo is also an MP for the Pasir Ris-Punggol Group Representation Constituency (GRC).

The Treelodge@Punggol features an eco-deck above the carpark, a playground built from recyclable materials, and a rainwater collection system, among other things.

Residents will also have a car sharing scheme at their disposal, which will include hybrid cars as well.

An additional centralised refuse chute for recyclables has been introduced for each block, in order to promote more waste recycling.

'It's something new. There were no other HDB flats that were indicated as eco-friendly then, and we were quite excited to get it,' said Christina Ng, the owner of the one-millionth flat, a four-room unit.

Ms Ng and her husband, Wang Weiji, balloted for the flat in 2007 and are first-time homeowners. They plan to move in after the Chinese New Year.

The development was launched in 2007 with seven blocks of 709 flat units in total, comprising three-, four-, and five-room flats.

Year-to-date, 3,300 new flats have been launched in Punggol by the HDB and another 1,000 new flats are due to be launched over the next few days.

'If demand remains strong, HDB is on track to complete 35,000 flats by the end of 2015,' said Mr Teo.

Last month, the HDB launched the tender for the first mixed commercial-residential site at Punggol Town Centre, which will be next to the Punggol Waterway and Punggol MRT station.

'The HDB story is also the story of hope and social mobility in Singapore,' said Mr Teo.

'Singaporeans know that if they work hard and budget wisely, they can aspire to upgrade to a better flat and a better life.'

In 2008, the HDB won the United Nations Public Service Award for its Home Ownership Programme.

This was followed by the UN-Habitat Scroll of Honour Award 2010, which was given to the HDB for 'providing one of Asia's and the world's greenest, cleanest, and most socially conscious housing programmes'

Source; www.businesstimes.com.sg

Posted by IM at 2:38 PM

Labels: HDB, hdb singapore, Mah Bow Tan, Property News, residential property, The Treelodge at Punggol

COV fell to $22,000 last month

National Development Minister says the market has not yet felt full impact of cooling measures

by Joanne Chan

Updated 12:32 PM Dec 07, 2010

SINGAPORE - While cash-over-valuation (COV) and the number of transactions in the Housing Board resale market are heading south, National Development Minister Mah Bow Tan believes it will be another one to two months before the full impact of the Government's cooling measures is felt.

In an exclusive interview with MediaCorp, Mr Mah revealed that the median COV last month was $22,000, down $3,000 from that for October. This marks the second month in a row the COV has fallen, a sign property cooling measures set in August are taking effect,

And the number of HDB resale transactions has fallen some 30 per cent in the fourth quarter thus far compared to last quarter.

The COV hit a high of $30,000 for two straight quarters this year, sparking concerns that first-time home-buyers might be priced out of the resale market.

Said Mr Mah: "Now, you are seeing that resale prices and the COV are not only stabilising but are starting to come down. So, I think there's really no need to rush (to buy a flat)."

Transaction numbers from property firm Dennis Wee Group (DWG) also reflect the downward trend of COV and sale volume.

DWG director Chris Koh said he expects the COV to drop to $20,000 this month.

He said: "Things usually slow down (in December) because of Christmas, New Year, school holidays ... So, with the measures in place, (and) with new flats coming up, we should see demand ease off a little."

Mr Mah said the Government was comfortable with the current situation and there was no need for further cooling measures for now. More steps would be taken only if necessary, he added.

While prices appeared to have stabilised, Mr Mah acknowledged housing "would probably be more (of) an issue" at the next General Election.

He said: "It's always been an issue at every election as far as I can remember ... The main thing is that in an election, we have to offer - to the residents (and) voters - our platforms, our polices. Whoever can convince the voters they can do a better job in improving their lives will get and deserves to get the vote."

Source: www.todayonline.com

Posted by IM at 3:08 PM

Labels: Cash-Over-Valuation (COV), HDB, HDB resale, hdb singapore, Mah Bow Tan

More HDB resale matters available online

Published December 4, 2010

More HDB resale matters available online

By LYNN KAN

THE Housing and Development Board (HDB) is making resale transactions easier by moving more processes online.

This would be lead to lower online application fees for customers when compared with hard copy applications, and is also more environmentally friendly, said the HDB in a press release yesterday.

One of the changes made is that HDB is allowing all buyers, sellers and licensed housing agencies to book their first appointment dates for resale on HDB's e-Resale page from Jan 3, 2011.

Currently, buyers and sellers may only indicate their preferred date on e-Resale.

Previously, only agencies accredited by the Singapore Accredited Estates Agencies (SAEA) could set first appointment dates on the Internet by subscribing to ResaleNet.

HDB said that as of yesterday, ResaleNet was changed to allow all licensed housing agencies to be subscribers and set appointment dates.

The third major change is that from Jan 3, 2011, buyer and sellers, or their agents, may submit portions of the resale application separately rather than jointly.

Once HDB receives the first party's portion of the application, it would notify the other party through their MyHDBPage on the HDB website. The other party should submit their forms within seven days to book the first appointment. After that, the submission would then lapse and a fresh application would have to be made.

HDB has modified the rules after receiving feedback that buyers and sellers 'are not comfortable divulging their personal particulars to the other party, or their housing agents'.

HDB said that it would no longer be accepting hard copy resale applications and valuation requests from Jan 3, 2011.

HDB customers without Internet access may submit applications online at the e-Lobby at HDB Hub or at any HDB branch office.

Members of the public who require more information may e-mail hdbresale@hdb.gov.sg or call its enquiry line at 1800-866-3066 from 8am to 5pm, Mondays to Fridays.

Source: www.businesstimes.com.sg

Posted by IM at 8:24 AM

Labels: HDB, HDB resale, hdb singapore, residential property

Are HDB flats affordable?

Recently, the Housing and Development Board was conferred the UN-Habitat Scroll of Honour Award - the most prestigious human settlements award in the world. In recognising Singapore's achievement, the UN-Habitat Chief of Information Services said: "It's really quite impressive for a country to provide adequate shelter and home ownership for so many."

Ask most housing experts and observers, and they will say that HDB flats remain within reach of the majority of Singaporeans. After all, HDB builds and sells flats at heavily-subsidised prices to ensure affordability. This has made it possible for an average of 15,000 young couples every year to join the ranks of homeowners.

Most of these couples buying new flats use just 20 to 25 per cent of their monthly income to pay for their flats. With their CPF contributions, few have to pay any cash for their mortgage payments. In total, more than 80 per cent of Singaporeans live in 900,000 HDB flats today. Yet, people still worry that HDB flats are not affordable. Why are there such sentiments?

Indeed, housing affordability - whether a flat is within financial reach - is not a straightforward issue. Different people have different notions of what is "within reach". Some argue that a 30-year housing loan is too long for a flat to be considered affordable. Others say that flat prices are much higher compared to their parents' time. The debate is further complicated by rising aspirations - whether housing is "within reach" also depends on what we aspire towards.

For a meaningful discussion on affordability, we need objective and commonly accepted yardsticks. So, what are the measures of affordability? How does HDB ensure that flats remain within reach of Singaporeans?

MEASURES TO ENSURE AFFORDABILITY

Focus on first-timers. To ensure that first-time buyers have access to affordable housing, we do several things. First, HDB prices its new flats below market value, taking into account the income of homebuyers. Hence, first-timers enjoy a substantial subsidy when they buy new flats from HDB.

Next, for first-timers who cannot wait for a new flat or wish to buy a specific flat in a specific location, HDB provides a CPF Housing Grant of $30,000 (or $40,000 if they stay near their parents) to buy a resale flat. Beyond that, new and resale flat buyers can apply for a concessionary loan. For a $200,000 loan over 30 years, the interest subsidy amounts to about $30,000.

Help according to income. For households earning $5,000 or less a month, an Additional CPF Housing Grant of up to $40,000 is provided for their purchase of new or resale flats. In other words, a family earning $1,500 can get as much as $80,000 in housing grants. Families earning more, between $8,000 and $10,000, can now buy new flats under the Design, Build and Sell Scheme (DBSS), in addition to Executive Condominiums, and enjoy a CPF Housing Grant of $30,000.

MEASURES OF AFFORDABILITY

I have been discussing affordability in layman's terms. Let me now get into the technical stuff. In particular, how do experts determine housing affordability? There are a few generally accepted benchmarks.

Income affordability. One is the housing price-to-income ratio (or HPI), which compares median house price to annual household income.

In a Straits Times article in February 2010, two NUS professors, Tu Yong and Yu Shi Ming, noted that Singapore's HPI for resale flats in non-mature estates is 5.8, compared to Hong Kong's 19.8 and London's 7.1. That means Singaporeans generally need 5.8 times of their annual household income to buy a resale flat in non-mature estates, whereas a Hong Kong resident needs more than three times that amount.

If we take Department of Statistics 2009 data on the median income of younger households - those aged between 25 and 35 years old - who are likely to be first-timers, their HPI is even lower, at 4.5 for resale flats and 3.8 for new flats. This is because they have higher incomes than average households.

Financing affordability. While the HPI is relatively easy to understand, it does not consider factors like loan availability and financing costs, which are important for many deciding to buy a flat. Therefore, another widely-accepted measure is the debt-service-ratio (DSR), which looks at the proportion of the monthly income used to pay mortgages.

The DSR for new HDB flats in non-mature estates, based on an industry norm of a 30-year loan, averaged 23 per cent this year. This is well within the 30-35 per cent international benchmark for affordable expenditure on housing.

Depending on flat type, the DSR ranged from 11 per cent for standard flats to 29 per cent for premium projects like the Punggol Waterway Terraces, which cater to higher income households.

We must also remember that CPF savings can be used for the initial downpayment and monthly instalments. Hence, more than 80 per cent of new flat buyers pay for their housing loans entirely out of CPF, without having to touch their take-home pay.

Whichever objective measure we choose, it is clear that there are enough HDB flats within reach of today's homebuyers. They range from smaller, no-frills flats in non-mature estates to premium flats in mature estates, catering for different aspirations and budgets (see table above). I hope buyers choose carefully, taking into account their budgets and aspirations. Housing affordability is decided not just by the options offered by HDB but also the choices of homebuyers.

BALANCING HOMEBUYER AND TAXPAYER INTERESTS

I can understand the anxiety among young couples wanting to buy a flat of their choice, within their budget, and as soon as possible. HDB has ramped up supply significantly and recently introduced more measures to temper excessive exuberance in the market and to moderate prices.

HDB also regularly reviews its subsidies to ensure affordability. But I must caution that there are limits to how much we can increase subsidies, without compromising other interests.

In other words, we must also consider affordability from a national standpoint. If we increase housing subsidies, what would we have to give up? The quality of education for our children? Healthcare services for our parents? Or do we impose a higher tax burden on Singaporeans?

There are no easy answers. Ultimately, we need to balance the interests of affordability for homebuyers and the burden on taxpayers.

by Mah Bow Tan

05:55 AM Nov 12, 2010

The writer is the

Minister for National Development.

Source: www.todayonline.com

Posted by IM at 7:15 PM

Labels: Build-to-order (BTO), CPF Housing Grant, executive condominium, HDB, HDB resale, hdb singapore, Mah Bow Tan

Pricing flats according to their value

by Mah Bow Tan

05:55 AM Oct 29, 2010

The prices of HDB flats are always a subject of much public interest. In my conversations with young couples, a common question I hear is: "Why are HDB flats so expensive? Prices today seem much higher than what our parents paid in the 1970s and 1980s!"

I can understand these concerns, especially from those looking to buy their first homes. Yes, flat prices have increased over the years. But, in this article, I will explain why this has happened and, more importantly, why rising flat prices, if supported by economic fundamentals, is in the overall interest of everyone - homeowners and homebuyers.

PROVIDING A HOME AND ASSET

Singapore decided early on to promote home ownership. We subsidise public housing so that each family can own, rather than rent, its home. The flat becomes a store of value that can appreciate over time as the country develops. We are the only country in the world that has made affordable home ownership a major pillar of its public housing policy.

Resale at market versus cost - Unlocking value: Having chosen home ownership, we must then allow the true value of the flats to be recognised and realised.

Again, we have a choice: Do we require the flat to be sold back to HDB at a fixed price, or do we allow it to be sold on the open market? We have chosen the latter. We let the market determine prices but keep a close watch to temper excessive exuberance, where necessary.

Today, every HDB flat has an open market value which its owner can realise, after staying in it for a minimum period. The values of HDB flats today reflect Singapore's growth and prosperity since the 1970s and 1980s.

While owners may be happy that the value of their flats has gone up, what about first-time buyers? How do we fulfil our commitment to provide an affordable home for them? We do so in two ways: One, by giving them housing grants to buy resale flats; and two, by building new flats which are sold at subsidised prices - within the reach of various income groups.

Hundreds of millions are spent each year to subsidise first-time buyers. That is why the home ownership rate among young Singaporeans is so high, unlike many other cities in the world.

ENSURING FAIR PRICING OF NEW FLATS

For resale flats, we have allowed the market to determine their prices based on value. How do we set the prices for new flats? Broadly, there are two options: Price according to market value or price according to cost.

Fairness for all buyers: In the early years, HDB adopted a zonal pricing system, where the price of each new flat was fixed according to geographical zones. Pricing largely took into account the cost incurred in building the flats and the same price was charged for a given flat type within the zone, regardless of its actual location and attributes. A flat on the 10th floor was priced exactly the same as one on the second floor. Back then, there was practically no open resale market.

However, as we allowed the resale market to develop in the 1980s, buyers showed that they clearly valued different flats differently, depending on factors like location, view, and design.

They were willing to pay much more for a top-floor flat commanding the best view, compared to a lower-floor one facing the bin centre. HDB could no longer price a top-floor unit the same as one lower down.

To do so would be most unfair to the lower floor buyers. Therefore, HDB started moving towards market-based pricing.

New flats are now priced based on what professional valuers assess similar flats would fetch in the open market, but discounted with a substantial subsidy. This is fairer for two reasons. First, all buyers would get the same public subsidy that they can encash, if the flat were sold in the resale market. Second, buyers would pay for what they get, in terms of location, direction, view, etc.

Fairness across generations: Some have argued that land specifically should not be valued at market levels, since some plots had been compulsorily acquired in the past at low cost.

If we follow this logic, we should price a flat built on reclaimed land in, say, Punggol much higher than a flat in Tanjong Pagar built on land acquired by the state. Surely, this is not fair for the Punggol flat buyer, when the Tanjong Pagar flat clearly has a higher resale value? More importantly, we need to recognise the true market value of land, so that the precious limited land we have is used prudently and optimally. If land is undervalued, we will use up more land now at the expense of future generations.

Affordability to buyers: If market-based pricing is fairer, why do some people argue for cost-based pricing? Perhaps they believe that cost-based pricing means cheaper flats. But this is not true. To ensure affordability, HDB gives extensive subsidies below market value. As a result, market-based prices can be below cost. For example, for Punggol Spectra and Fernvale Crest - two recent Build-To-Order (BTO) projects - the average development cost per flat was $220,000 to $240,000, while the average selling price was $160,000 to $200,000, or $40,000 to $60,000 below cost.

HDB flats are generally priced below their development costs. Over the last three years, the average annual loss on the sale and development of HDB flats was around $600 million. If we include other housing subsidies, such as the Additional Housing Grant and the CPF Housing Grant, HDB's total annual deficit would be about $1 billion.

Housing affordability can be achieved under any pricing system. It all depends on the level of subsidy given. I know some first-timers worry that market-based pricing leaves them entirely at the mercy of market forces. Let me assure them that HDB reviews its subsidies regularly to ensure affordability for first time homebuyers. I will discuss this issue in greater detail in my next article.

RECOGNISING VALUE IN PRICING

Today, we have built a unique public housing system that is based on home ownership. It offers Singaporeans not only shelter but also a store of value. Singaporeans generally understand and are prepared to pay for value. This is why some of the higher-priced, premium HDB flats attract more buyers than the more affordable, standard flats. For example, there were 13 applicants per flat for the Punggol Waterway Terraces, compared to four to seven applicants per flat for standard BTO projects launched there this year.

We must price new HDB flats such that the public subsidies that can be realised on resale are fairly distributed across buyers. As the custodian of public wealth, the Government must also use its resources wisely, including land, regardless of how they were acquired, so that the needs of current and future generations of homebuyers can be met.

Recognising the value of the flat in its pricing is a key part of this.

The writer is the Minister for National Development.

Source: http://www.todayonline.com

Posted by IM at 8:52 AM

Labels: HDB, HDB Housing Loan, HDB resale, hdb singapore, Property News, singapore property, singapore real estate

HDB launches BTO projects in Bukit Panjang and Sengkang

Published October 27, 2010

HDB launches BTO projects in Bukit Panjang and Sengkang

A total of 1,322 units will be offered in the two projects

By UMA SHANKARI

THE Housing & Development Board has launched two more build-to-order (BTO) projects - Senja Parc View at Bukit Panjang and Anchorvale Horizon at Sengkang.

A total of 1,322 units - comprising 240 studio apartments, 112 two-room flats, 112 three-room flats, 710 four-room flats and 148 five-room flats - will be offered.

Including these, HDB has now offered 15,527 new flats for sale under the BTO and sale of balance flat exercise this year.

And in the first quarter of next year, it will launch about 5,000 BTO flats as part of the supply of 22,000 new flats planned for 2011.

The upcoming BTO projects will have a good geographic spread, in towns such as Bukit Panjang, Jurong West, Sengkang and Yishun, HDB said yesterday.

Apartments at the 577-unit Senja Parc View, which is bounded by Senja Road and Kranji Expressway, are priced at $86,000 to $119,000 for a two-room flat; $149,000 to $191,000 for a three-room flat; and $242,000 to $312,000 for a four-room flat.

Flats at the 745-unit Anchorvale Horizon, located at the junction of Anchorvale Road and Sengkang East Way, are pricier as they are 'premium' flats.

Units there will sell for $75,000 to $104,000 for a studio apartment; $277,000 to $344,000 for a four-room flat; and $344,000 to $426,000 for a five-room flat.

HDB estimates that first-time flat buyers will use 17 to 27 per cent of their monthly household income to meet their monthly loan payments for flats in Senja Parc View and Anchorvale Horizon.

Market watchers expect Anchorvale Horizon to be more popular.

'The immediate area around Anchorvale Horizon is more developed than the immediate area around Senja Parc View,' said PropNex corporate communications manager Adam Tan.

He pointed to various sports facilities that will appeal to the younger generation and the connectivity offered by the nearby expressway and LRT stations.

At Senja Parc View, the main attraction is expected to be the low cost of the flats.

http://www.businesstimes.com.sg

Posted by IM at 7:08 AM

Labels: Build-to-order (BTO), HDB, hdb singapore, Property News, singapore property, singapore real estate

HDB to roll out more BTO flats in 2011

Published October 22, 2010

It plans to launch up to 22,000 BTO flats in 2011 if strong demand persists

By EMILYN YAP

THE Housing and Development Board (HDB) will continue to roll out new flats through the build-to-order (BTO) programme every month even as the application rates for recent launches slide.

HDB CEO Cheong Koon Hean said this at a briefing on the board's FY09/10 annual report on Wednesday, which showed resale transactions between April 2009 and March this year reaching a seven-year high.

'We are still committed to launch every month, but we will monitor carefully. The programme can be adjusted,' Mrs Cheong said.

HDB ramped up its BTO programme from late last year to cater to rising demand for flats.

It was common to see launches in the early months of this year attract six to seven applications per unit offered.

But application rates have dropped after the government introduced measures to cool the property market in August.

Last month, a BTO exercise at Yishun attracted around 2.4 applications for every flat offered. Another exercise this month at Woodlands saw a rate of 2.2 applications.

'It is probably too early to really tell what is the impact of the measures,' Mrs Cheong said.

In any case, the BTO programme allows HDB to gauge demand for flats and adjust supply accordingly, she stressed.

This calendar year, HDB will be launching about 16,000 BTO flats - the highest number offered in any calendar year since it adopted the BTO system in 2002. Last year, it released 9,000 BTO flats.

HDB plans to launch up to 22,000 BTO flats in the next calendar year if strong demand persists.

There was robust appetite not just for new flats, but also for resale flats.

HDB revealed in its annual report that there were 39,320 resale applications in FY09/10. This is the highest number seen since FY02/03, it told BT.

HDB also said that the average number of resale transactions in recent years has been fairly constant at about 30,000. In FY08/09, it received 28,551 applications.

For FY09/10, HDB incurred a deficit of $907 million, less than the deficit of $2.12 billion a year ago.

The improvement was driven by a sharp drop in net operating expenditure, to $3.94 billion from $5.15 billion.

HDB's residential ancillary functions arm narrowed its deficit to $64 million from $120 million.

This was largely due to an increase in season parking income and licence fees received for car parks outsourced to external service providers.

HDB said that season parking income rose because there were higher season ticket sales from a larger car population.

It also outsourced more car parks to private operators, which generated higher licence fees.

http://www.businesstimes.com.sg

Posted by IM at 7:55 AM

Labels: Build-to-order (BTO), Government Land Sales, HDB, hdb singapore, land for sale, singapore property

Buying a flat? Choose wisely

Updated 02:34 PM Oct 15, 2010

by Mah Bow Tan

"Shall we apply for an HDB flat?" This is how Singaporean men propose to their beloved. So we are told - I am not sure how common this is. However, this uniquely Singaporean marriage proposal reflects a common aspiration among many young couples intending to wed - getting an HDB (Housing and Development Board) flat.

This desire to own a marital home has remained unchanged over the years. But what buyers want from a home has changed. As our nation and people progressed, their hopes and dreams for housing have risen and become more diverse. How has HDB's housing programme responded to these changing aspirations?

Responding to Rising Aspirations

Providing housing to the masses. The Government's core commitment - to provide affordable housing for the masses to build an inclusive home - remains firm and clear. But housing the masses is no longer just about providing a basic shelter. People ask me: Why doesn't HDB stick to providing basic housing? The answer is simple: Our people have changed and they no longer want only basic housing.

The proportion of HDB residents with tertiary education, for example, has increased five times over the last 20 years, from 6 per cent in 1987 to 31 per cent in 2008. Average household incomes have also increased almost four times over the same period, from $1,500 in 1987 to $5,700 in 2008.

Offering a wider range of flat types. In the early days, when we faced a huge housing shortage, HDB focussed on building simple and functional one-, two- and three-room flats as quickly as possible.

But in the 1980s, with rising affluence, there were few takers for smaller flats. Therefore, HDB had to build more four-room, five-room and Executive flats. With economic growth becoming more volatile in the late 1990s and 2000s, HDB resumed the building of three-room flats (in 2004) and two-room flats (in 2006). These flats provided options for lower income households and those wanting to right-size their homes as they age.

Offering a wider range of designs. Buyers of new HDB flats range from those earning less than $1,500 a month to those earning up to $10,000 a month. To provide greater choice and variety for higher income buyers, HDB allowed private developers to participate in public housing projects, first through the Executive Condominium Housing Scheme in the 1990s, and later through the Design Build and Sell Scheme in the 2000s.

Several new HDB developments also feature innovative designs and test new concepts for public housing. The award-winning The Pinnacle @ Duxton, HDB's first 50-storey development featuring seven blocks linked by skybridges, is particularly close to my heart.

The project is historically significant as it stands on the site of HDB's first flats in the area - two slab blocks completed in the 1960s. It visibly symbolises the transformation of Singapore and our public housing programme over the past 50 years.

To turn this project into reality, I had to persuade my Cabinet colleagues to keep this prime downtown location for public housing, instead of selling it to private developers. I also asked HDB to organise an international design competition to attract the best designs for the project.

The Waterway Terraces at Punggol is another example of unique design, setting new benchmarks for waterfront living for public housing.

Making Choices within Our Means

Staying focused on standard flats. More flat choices inevitably mean a wider range of flat prices. The old days - when HDB flats were all uniform slab blocks sold at similar prices - can no longer remain.

The premium flats, with better designs, better finishes and at better locations, will command a premium. However, these form only a fraction of new flats offered. The bulk of HDB's supply will remain good quality standard flats, offered in a wide variety of locations and more affordable for Singaporeans.

Buying within our means. It is natural for all of us to want a better home. I am encouraged that HDB's premium developments such as The Pinnacle@Duxton and Waterway Terraces at Punggol have been popular and have kept pace with Singaporeans' aspirations. But I also worry that as we provide greater choices to meet diverse aspirations, some may overstretch their budgets to buy these flats.

HDB offers a range of flat choices for every budget. For example, a household earning $5,000 a month can choose a more centrally located 3-room flat in Toa Payoh, a 4-room flat in Bedok, or a 5-room flat further away in Woodlands (see table). I urge home buyers to consider the trade-offs between the price, size and location of the flat, and carefully choose one that best suits their needs and budgets.